Cryptocurrencies have been scorching commodities at varied instances over the previous decade when it appeared like their worth charts have been going to endlessly transfer up and to the correct. However 2022 was not a type of instances. Mainstream cryptocurrencies like Bitcoin dropped in worth by over 50% within the final 12 months, and a few cryptocurrencies, like Shiba Inu, fell over 70%.

A part of the drop might be defined by latest stories of fraud associated to FTX Buying and selling and its founders Sam Bankman-Fried and Gary Wang. Some naysayers additionally prefer to level out issues in regards to the business over currencies that seem to haven’t any underlying enterprise fundamentals, making them next-to-impossible to precisely worth.

Placing your hard-earned financial savings into one thing that has numerous hype related to it did not serve traders properly in 2021 and it nonetheless is not in 2023. Somewhat than taking an opportunity on the still-unproven crypto business, traders would possibly need to as an alternative concentrate on these three ironclad shares for his or her portfolio.

1. Dropbox: Regular recurring income

Dropbox (DBX 0.27%) was one of many hottest start-ups that got here out of Silicon Valley within the early 2010s, even eliciting a well-known acquisition provide from Apple founder Steve Jobs. Since then many individuals have forgotten in regards to the file storage and office administration software program firm, and its inventory worth now hovers about 20% beneath the IPO worth set in 2018.

The inventory could also be down, however the enterprise has completed simply advantageous in that point, establishing a fantastic shopping for alternative for long-term traders. Final quarter, Dropbox’s paying customers hit 17.55 million, up from 12.3 million in the identical interval in 2018, with common income per person (ARPU) going from $118.60 to $134.31 over that very same time-frame. It is a recipe for regular top-line development, which Dropbox has exhibited since going public. Final quarter, annual recurring income (ARR) hit $2.4 billion.

Dropbox can be extremely worthwhile, producing $736.4 million in free money movement during the last 12 months. By 2024, administration has a purpose of hitting $1 billion in annual free money movement. At a present market cap of $8 billion, that offers the inventory a trailing price-to-free-cash-flow (P/FCF) ratio of 11 and a ahead P/FCF ratio of 8 primarily based on its 2024 steerage. For a enterprise with recurring income and constant development, Dropbox appears like a steal at these costs.

2. Alphabet: A monopoly in serps

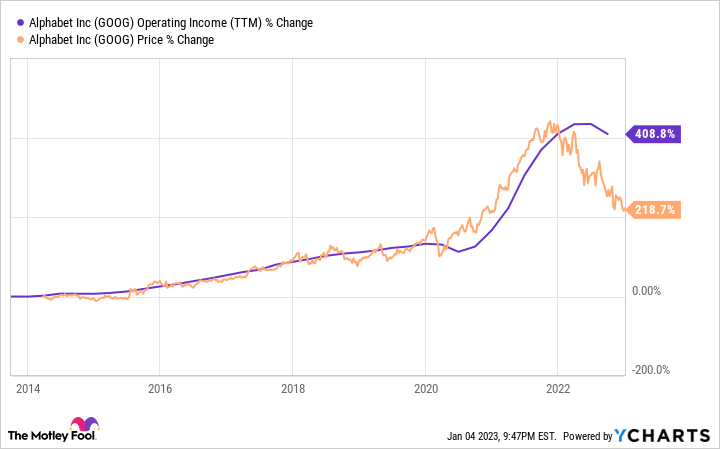

Transferring to a a lot bigger enterprise, let’s take a look at Alphabet (GOOG 1.60%) (GOOGL 1.32%), the expertise big that owns Google, YouTube, Waymo, and different properties. The vast majority of this enterprise remains to be pushed by Google Search, which generated $39.5 billion in income final quarter, 57% of Alphabet’s total gross sales. During the last 12 months, the enterprise generated $78.5 billion in working earnings, a quantity that’s up 400% within the final 10 years and the important thing driver of Alphabet’s inventory efficiency over that time-frame.

Going ahead, increasingly of Alphabet’s long-term development will possible be pushed by the a lot youthful YouTube and Google Cloud companies. Each segments produce lower than $10 billion in quarterly income (which is small for Alphabet) however have put up spectacular development charges previously few years. And remember Waymo, Alphabet’s autonomous driving unit, which is the chief within the fast-growing business. The subsidiary’s taxi service has solely launched in a few markets round america and contributes little or no to the corporate’s consolidated financials proper now. But it has massive potential if it might probably go world with an autonomous taxi community.

GOOG Working Revenue (TTM) knowledge by YCharts

With a dominant place within the search market and loads of smaller companies rising shortly, Alphabet appears like an ideal inventory for traders searching for diversified development over the lengthy haul.

3. Altria Group: For these comfy with tobacco firms

For many who are excited by tobacco shares, Altria Group (MO 2.38%) is a superb dividend inventory to place in your portfolio.

The corporate is the proprietor of Philip Morris, which itself sells the favored Marlboro cigarettes model within the U.S. Altria Group (and all its different former company names) is among the best-performing shares of all time. The corporate managed to ship a mean 17.7% complete annual return from 1926 by means of 2016. That’s the magic of compound curiosity and regular business income.

MO Free Money Stream Per Share knowledge by YCharts

Admittedly, Altria has not generated complete returns at these excessive ranges since 2016. Altria Group is at the moment a low-growth inventory that rewards traders now largely by means of dividends, paying out nearly all of its earnings to shareholders. During the last 12 months, its dividend per share was $3.64 (at the moment yielding 8.3%), which is barely lower than the $4.46 in free money movement it generated per share. That is the other of a nugatory cryptocurrency, with Altria’s returns pushed by constant earnings energy that grows 12 months after 12 months and continues to fund that giant dividend.

Altria Group does have one downside although, and that’s declining cigarette volumes throughout america (its major geography). To counteract this, the corporate has invested closely in much less dangerous merchandise like nicotine pouches, hashish, and vaping. A few of these have not labored out, however shareholders ought to be happy that administration has a long-term view for this enterprise. At a brilliant excessive dividend yield of 8.3%, traders stand to learn from having Altria Group shares of their portfolios over the subsequent decade.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Apple, and Bitcoin. The Motley Idiot recommends the next choices: lengthy March 2023 $120 calls on Apple and quick March 2023 $130 calls on Apple. The Motley Idiot has a disclosure coverage.

from Cryptocurrency – My Blog https://ift.tt/XCrvuAk

via IFTTT