The mining trade began 2022 off robust with what appeared like ample capital to develop, however excessive vitality costs, rising competitors for Bitcoin blocks and a bear market hit miners, knocking out these with excessive leverage.

The sector was shaken by bankruptcies and mortgage defaults, and subsequent 12 months will possible deliver much more ache, as miners wrestle to bolster their stability sheets and operations. However it’ll additionally current a chance for these ready to purchase property, in addition to for these that may enhance their margins with new improvements.

CoinDesk spoke to among the high executives and analysts in bitcoin mining to assessment previous 12 months and predict tendencies for 2023. Right here’s what they stated.

Progress didn’t come

Business individuals say that numerous cash was spent over the past 12 months to spice up hashrate, a measure of computing energy on the Bitcoin community, however that in lots of circumstances, these investments didn’t repay, as firms loaded up on debt to finance the expansion solely to see the economics of crypto mining break down.

“Many miners acted too deterministically,” projecting bitcoin (BTC) would hit $100,000 and never even contemplating that the worth would drop under $20,000, stated Juri Bulovic, head of mining at crypto mining and staking agency Foundry, which is owned by CoinDesk’s dad or mum firm, Digital Forex Group.

With falling bitcoin costs, many firms had hassle assembly their debt obligations.

Learn extra: Bitcoin Miners’ FTX Contagion Publicity Might Amplify Business Ache

“There aren’t some ways to financially materialize these plans. One both sells bitcoin, borrows money owed or points fairness. When promoting mined bitcoin was barely sufficient to cowl OpEx (working bills), many opted for debt financing because the fairness market turned chilly,” stated Wolfie Zhao, head of analysis at TheMinerMag, the information and analysis arm of mining consultancy BlocksBridge.

Learn extra: Crypto Miners Face Margin Calls, Defaults as Debt Comes Due in Bear Market

On the flip slide, lenders have been too optimistic.

“Many had not been in a position to correctly assess the dangers related to such mining rigs-backed loans provided that that is the primary cycle during which such loans got out,” Bulovic famous.

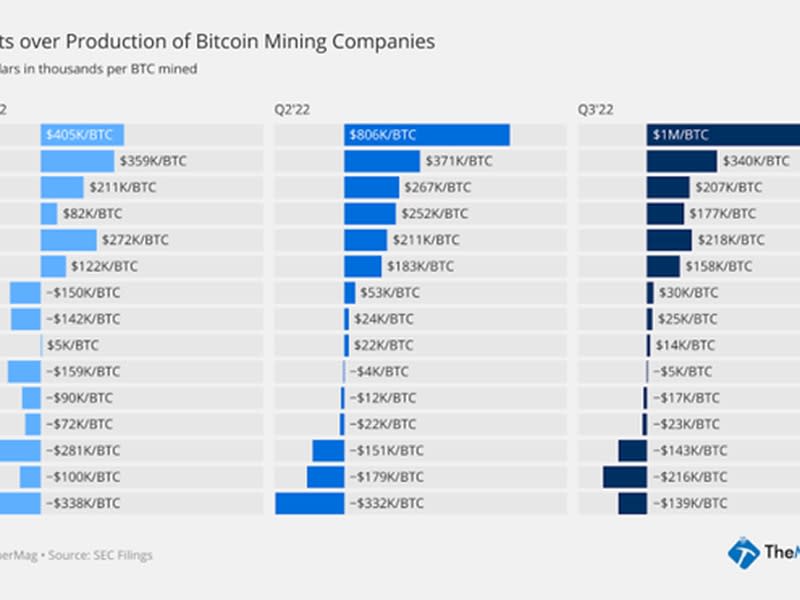

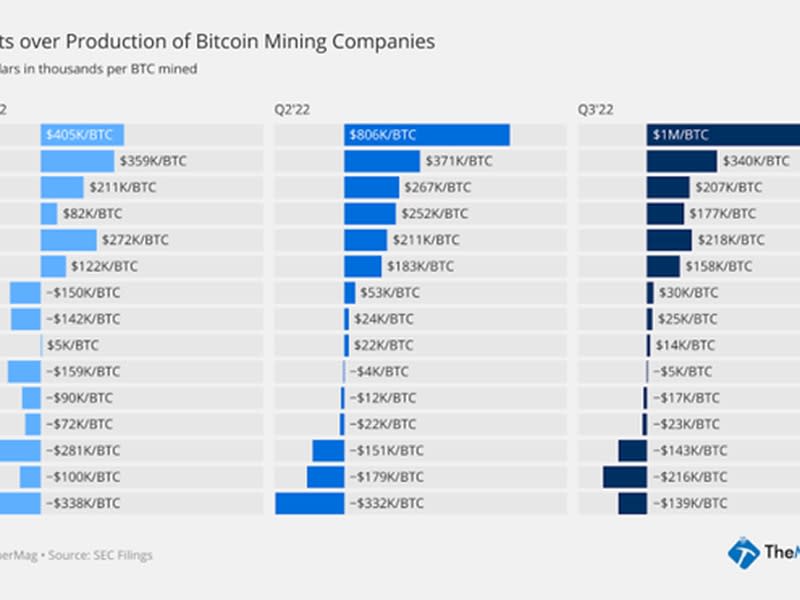

Some miners noticed their debt-to-equity ratio, a measure that reveals an organization’s monetary leverage, greater than triple within the third quarter, in line with TheMinerMag information.

Unsurprisingly, miners that had excessive debt-to-equity ratios, like Core Scientific (CORZ), Greenidge Technology (GREE) and Stronghold Digital Mining have needed to both file for chapter or restructure their debt obligations.

Hedging and treasury administration

Many miners additionally did not hedge their dangers towards a falling bitcoin worth.

“Bitcoin miners have a lot to be taught from conventional commodity-producing industries like oil and gasoline. As an alternative of utilizing monetary devices to extend their lengthy oil publicity, oil producers hedge their publicity by promoting oil futures. Hopefully, this bear market will encourage miners to lower their bitcoin worth danger via extra refined danger administration,” Jaran Mellerud, an analyst at Luxor Applied sciences, a supplier of bitcoin-mining companies, stated. Luxor opened a derivatives desk to promote hedging merchandise to miners in October, though the concept of hedging with derivatives had already began to sow its seeds throughout the miners because the broader market crumbled.

“I actually suppose traders need two issues – they need transparency they usually need predictability – and that is what hedging brings to a miner,” stated Chris Bae, founder and CEO of digital-asset buying and selling agency Enhanced Digital Group. Bae’s agency supplies hedging merchandise to miners which can be attempting to implement risk-management methods. Different firms resembling crypto-focused financial-services agency Galaxy Digital and Singapore-based digital-asset administration platform Metalpha are additionally offering hedging companies to miners.

TheMinerMag’s Zhao identified that it wasn’t solely overleverage that has introduced some miners to their knees, but additionally lack of treasury administration.

“If Core had been promoting half of its mined bitcoin each month and holding the remaining since January 2021, it possible will not be so troubled as it’s now whereas nonetheless having a number of Ok [thousands] of BTC on its stability sheet to seize the long-term upside,” he stated, referring to Core Scientific, a miner that filed for chapter in December.

As an alternative, the world’s largest miner by hashrate waited “till Might when the market ache began to essentially kick in” to begin promoting its amassed digital property, Zhao stated.

Miners that had a excessive proportion of debt relative to their bitcoin manufacturing have discovered themselves underneath water.

“5 of the six firms with the biggest internet money owed per BTC mined have had some stage of restructure for the reason that second half of this 12 months, except for Marathon Digital Holdings (MARA)],” Zhao stated.

The analyst thinks that Marathon has bucked the development partly as a result of the mining agency raised $750 million final 12 months in unsecured convertible notes with a 1% coupon fee. Core Scientific, against this, raised $500 million in secured convertible notes with a ten% fee.

Marathon can also be working to cut back its debt obligations, the agency instructed CoinDesk.

Extra ache forward

Nonetheless, Jaime Leverton, CEO of Canadian miner Hut 8 (HUT), predicts the worst is but to return by way of capitulation and bankruptcies, significantly within the first half of 2023, and he or she’s undecided that aid will come within the second half.

Luxor’s Vera stated he expects many firms to be taken personal, saying firms can acquire efficiencies by internet hosting and working machines.

However Fiorenzo Manganiello, founding father of Cowa, a mining and venture-funding agency, stated patrons could also be higher off simply buying bitcoin, reasonably than coping with hassles of proudly owning and working machines.

For the remainder of the pack, the 12 months seems to be like a 12 months of survival and restoration.

“Except we see a full-scale bull market, which I doubt we are going to, miners will use 2023 to strengthen their stability sheets and enhance their working efficiencies. The 12 months’s largest tendencies will probably be value minimization and debt discount,” Mellerud stated.

Learn extra: Bitcoin Miners’ FTX Contagion Publicity Might Amplify Business Ache

Energy wrestle

In 2023, miners won’t solely have to seek out the very best vitality offers, however get inventive about how they’ll decrease their prices or usher in income by tweaking their energy consumption and provide, trade specialists say.

As margins proceed to compress, miners should take a look at how they’ll take part in “demand response applications,” which means promoting energy again to the grid in instances of excessive demand, in addition to recapturing warmth from mining rigs and utilizing stranded vitality, Bulovic stated. “Miners who’ve an actual grasp on the processes, insurance policies, laws and technical know-how of those adjoining industries will acquire an edge over the opposite miners,” he stated.

Learn extra: Bitcoin Miners Powered Off as Winter Storm Battered North America

Crypto mining is changing into a much bigger a part of the vitality trade, and by the top of 2023, extra firms will should be vertically built-in, with their very own energy supply so as “to keep up long-term secure operation, because the halving is simply getting nearer,” in line with Daniel Jogg, CEO of Enerhash, a Hungary-based firm that runs blockchain information facilities. Halving is when the variety of bitcoin mined per block drops by 50%.

One other lesson associated to the significance of managing energy prices is on internet hosting, the enterprise mannequin during which corporations usher in income for proudly owning and working the infrastructure. “Excessive vitality costs and low bitcoin costs have been significantly arduous on this mannequin,” Zach Bradford, CEO of crypto miner CleanSpark (CLSK) stated.

Compute North, the primary massive agency within the trade to go bankrupt, was primarily a internet hosting agency. Core Scientific was additionally dropping cash in its internet hosting enterprise – about $10 million within the third quarter.

Learn extra: Core Scientific Once more Raises Bitcoin Mining Internet hosting Charges

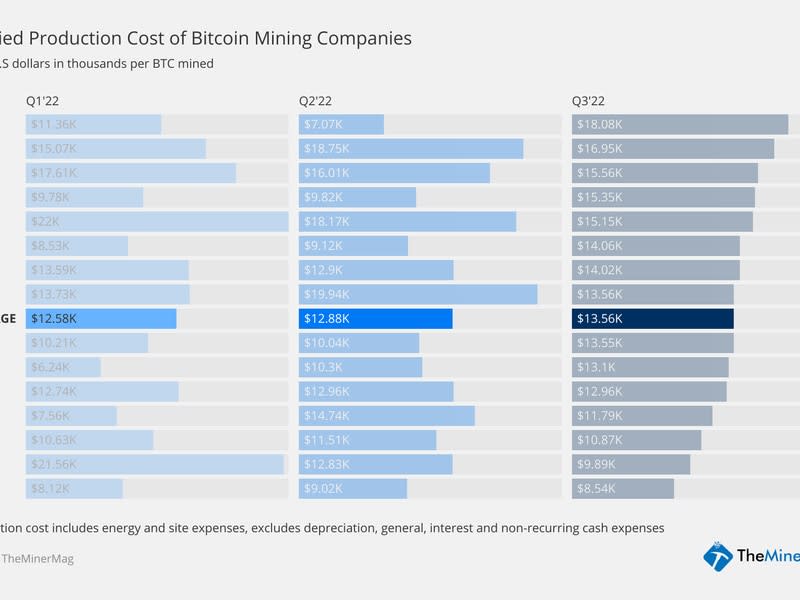

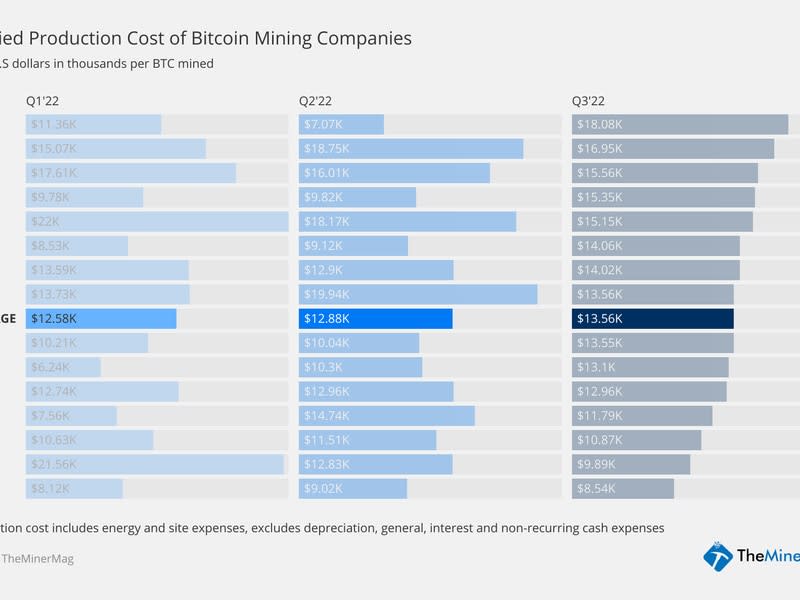

Mining corporations like Digihost (DGHI), Greenidge Technology, and Argo Blockchain (ARBK), that relied on pure gasoline or the electrical energy grid for his or her energy, noticed their prices skyrocket within the third quarter, in line with the information from TheMinerMag.

The development of value per bitcoin produced over the 12 months “seems to be similar to the united statesaverage family vitality worth improve this 12 months. The common of all the most important mining firms’ value of manufacturing per BTC mined has gone up by 7% in Q3 in comparison with Q1,” Zhao stated.

New know-how

As miners attempt to turn out to be extra environment friendly and produce down energy prices, they may find yourself taking a counterintuitive path – underclocking mining machines. That’s the apply of “decreasing vitality consumption and complete hashrate to enhance vitality effectivity,” which is “among the finest and most available applied sciences”to enhance efficiencies and management prices, Ben Gagnon, chief mining officer at Canadian miner Bitfarms (BITF), stated.

Nascent applied sciences like immersion and hydro cooling are additionally gaining popularity, however it’s unsure whether or not miners will deploy them at scale sooner or later due to value issues.

Immersion cooling entails submerging mining machines in a tank of fluid, whereas hydro cooling entails a brand new technology of mining rig, that are closely promoted by Bitmain, the world’s largest mining machine gear producer. Hydro machines have tubes positioned near the chips. Fluids undergo these tubes, taking warmth out of the machine. These rigs require a particular infrastructure to run, and infrequently to deal with the water such that it doesn’t degrade the tubes over time.

Learn extra: Amid Market Rout, Crypto Miners Are Nonetheless Constructing

“Although the present mining economics has disincentivized miners from experimenting with these new applied sciences, we do anticipate to nonetheless see progress being made in 2023 to advance the know-how and decrease prices,” Foundry’s Bulovic stated.

Aydin Kilic, president and chief working officer at Canadian crypto miner Hive Blockchain (HIVE), touted the Hive Buzzminers, a brand new mining rig constructed utilizing Intel’s (INTC) extremely anticipated Blocksale chip. These mining machines would be the first ASIC (application-specific built-in circuit) miner deployed by any of the most important public crypto mining firms and designed in-house, he stated.

The evolving geography of mining

The previous 12 months began with a noticeable centralization of the bitcoin mining hashrate within the U.S. In January, the U.S. accounted for about 38% of computing energy on the Bitcoin blockchain, and Canada virtually 7%, in line with the Centre for Various Finance on the College of Cambridge. Subsequent 12 months, that development is perhaps damaged. Luxor’s Mellerud and COO Ethan Vera each anticipate miners emigrate to South America, the Center East and Southeast Asia resulting from availability of low cost electrical energy.

Hut 8’s Leverton stated that this decentralization is her “hope,” provided that bitcoin is meant to be a distributed community, not aggregated in a single specific jurisdiction, though she famous that political instability could possibly be an impediment in some international locations.

Learn extra: Bitcoin Miners’ Excessive Hopes for Latin America Dented by Paraguay

Environmental issues

Many locations are involved about bitcoin mining’s vitality use and its impression on native communities, and in 2022, they began setting limits.

Prior to now 12 months, New York state enacted a two-year moratorium on new bitcoin mining operations, lawmakers within the U.S. are focusing on the trade’s vitality use, utilities in three Canadian provinces have stopped approving new bitcoin mining connections to the grid, and a invoice is into consideration in Kazakhstan that may cap the vitality out there to miners.

Business specialists stated they don’t anticipate any regulation on the federal stage within the U.S. or Canada within the coming 12 months, however native or state governments may proceed to position restrictions on the trade.

Gagnon of Bitfarms sees this small-scale regulation as an vital testing floor for any federal legal guidelines to return within the years forward.

Vera, nevertheless, cautioned that the moratorium set by New York state “units a difficult precedent” for the remainder of the U.S. for enlargement of latest mining farms. New website developments throughout states managed by Democrats are more likely to be focused by regulation, he stated.

Mellerud stated that in Europe, the European Union regulators will probably be “extra aggressive towards bitcoin miners in 2023.”

Because the continent “struggles with its vitality disaster, energy-intensive industries like bitcoin miners turn out to be pure scapegoats that regulators might goal to attain some low cost political level,” he stated.

Learn extra: Europe’s Final Bitcoin Mining Refuge Is No Longer Viable

from Bitcoin – My Blog https://ift.tt/S1sZx5T

via IFTTT