After days of muted buying and selling and crushed volatility, the crypto market got here again swinging on Monday as cryptocurrencies with smaller market capitalizations rallied, outperforming the blue chips bitcoin (BTC) and ether (ETH).

Among the many greatest gainers was FTT, the token of the crypto change that failed spectacularly in November, leaping 55% previously 24 hours. (It’s nonetheless down 96% over the previous 12 months.)

Serum (SRM), the native token of the Solana-based decentralized change, surged 28% on the day.

ZIL, the Zilliqa blockchain challenge’s native token, elevated 37%, whereas the native token of the Aptos blockchain, APT, recognized for its rocky launch and enterprise capital backing, gained 30%.

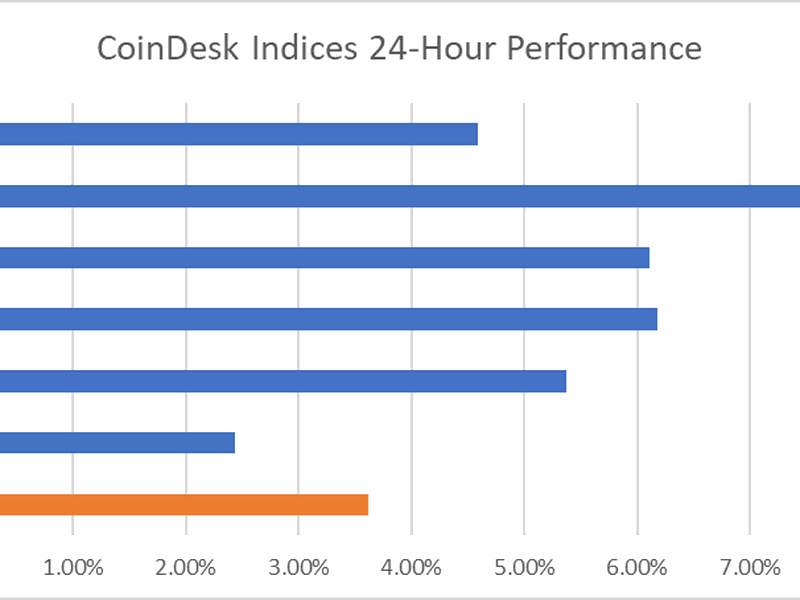

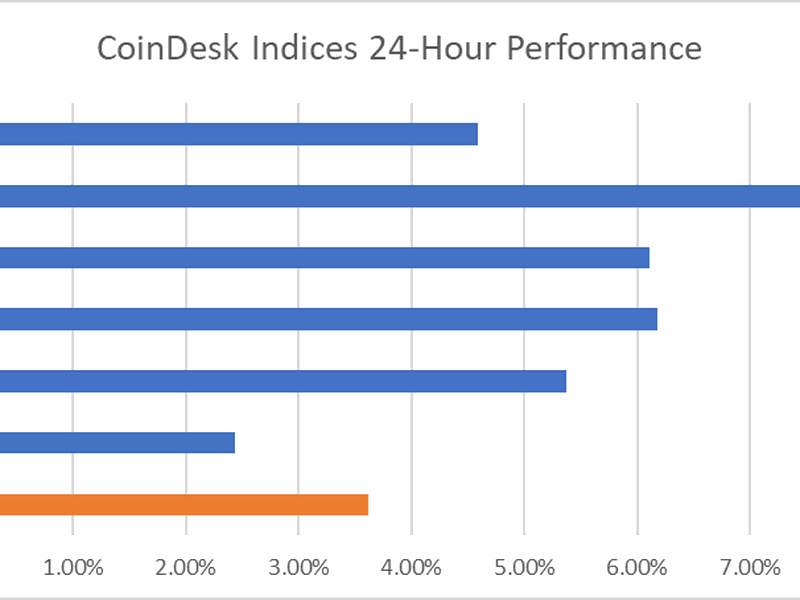

For comparability, the broad CoinDesk Market Index (CMI) was up 2.8% over the previous 24 hours.

The sudden surge caught merchants off-guard betting on cryptocurrency costs to fall. Up to now 24 hours, merchants liquidated some $245 million of quick positions, in accordance with Coinglass knowledge. Monday’s was the most important every day quick liquidation since Nov. 10, when crypto change FTX’s agony earlier than its final demise stirred up value volatility within the crypto market.

The value motion got here after BTC, the most important cryptocurrency by market capitalization, retook the $17,000 value degree after buying and selling in a variety for 3 weeks, bettering sentiment within the broad crypto markets.

Learn extra: Bitcoin’s Modest Rally Sends Crypto-Associated Shares Sharply Increased

Alex Kruger, a preferred crypto analyst on Twitter, informed CoinDesk that exhausted sellers and skinny liquidity fueled a reduction rally for smaller tokens.

“Many altcoins noticed robust year-end promoting flows that had been compounded by derivatives merchants front-running such flows,” he stated. “Then, shorts received squeezed.”

A sign of merchants’ excessive bearish positioning earlier than Monday’s value improve was the funding charges for perpetual swaps of solana (SOL) sinking to 1,000% annualized price. Then SOL gained 20% and a few $15 million of quick bets had been liquidated, in accordance with Coinglass.

Traditionally, the surge of small-cap tokens and meme cash has been an ominous signal for market individuals. Usually it preceded native tops for crypto costs earlier than a correction, as merchants rotated their good points from prime digital belongings to small tasks then dumped available on the market.

Nevertheless, Kruger predicted that the worth restoration in crypto will proceed, evaluating the current situations to early 2019 after the crypto market backside, however the stellar run for altcoins may come to an finish.

“The extraordinary outperformance relative to BTC and ETH ought to be gone, as funding charges lastly reset to regular ranges on Monday night time.”

“That is nonetheless a bear market and merchants would do effectively to train warning,” he added.

from Cryptocurrency – My Blog https://ift.tt/OytZcEr

via IFTTT