The favored crypto pockets MetaMask has launched its staking performance, which means that customers can now lock up their Ethereum via the brand new characteristic by way of Lido or Rocket Pool to earn monetary rewards.

What which means is anybody with a MetaMask pockets can now simply begin incomes yield on any quantity of ETH they’d like proper from their pockets, and with out having to navigate what can usually be sophisticated consumer interfaces on staking purposes. However ought to they?

Staking, in any case, isn’t with out threat—to not point out the truth that unstaking (i.e. getting your ETH again from a staking contract) isn’t an choice proper now. Ethereum builders say, nonetheless, that this characteristic will likely be coming quickly.

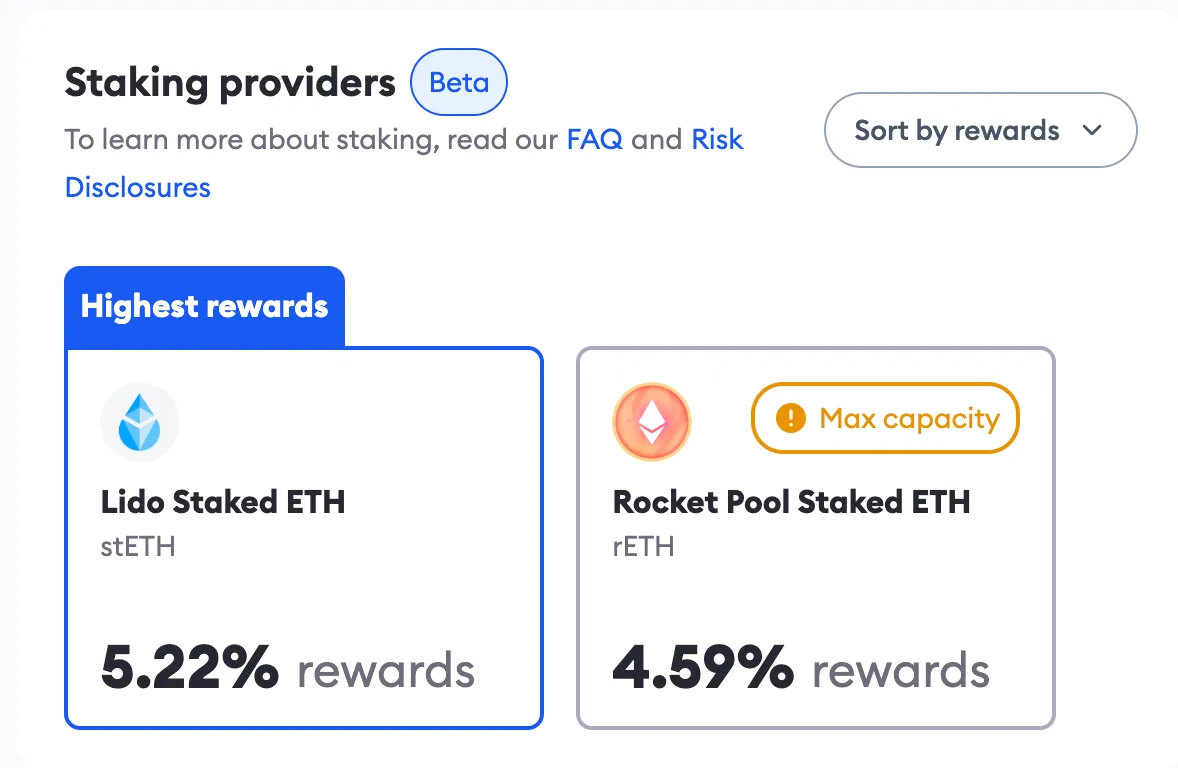

Staking Suppliers

For customers who don’t thoughts the dangers, staking could be a profitable exercise. Whereas the rewards charges differ, MetaMask’s website claims customers can earn a yield of about 5.22% per yr on ETH deposits with Lido, and 4.59% with Rocket Pool.

In line with Lido’s web site, over $6.9 billion of ETH is at the moment staked via its service, incomes customers roughly 4.9% yearly. Lido is a so-called liquid staking supplier, which means customers who stake ETH via Lido obtain an equal quantity of Staked Ethereum (stETH) in return for his or her staked tokens. This permits stakers to stay “liquid” whereas locking up their ETH, permitting them to make use of their stETH on different DeFi companies.

Staked Ethereum at the moment trades at a slight low cost to ETH. Whereas ETH is priced at round $1,418, stETH at the moment trades for $1,407, per CoinGecko information.

Lido is at the moment the most well-liked staking supplier, with 29% of all staked ETH, in accordance with Dune Analytics information.

Rocket Pool is one other liquid staking service, which offers customers with rETH in return for his or her staked tokens. However Rocket Pool on MetaMask seems to have already reached “max capability,” which means customers could solely have the choice to stake ETH via Lido on MetaMask for now.

What number of have already staked via MetaMask to this point? Whereas MetaMask’s Senior Product Supervisor Abad Mian didn’t supply exact numbers, he advised Decrypt that the crew is happy with the rollout to date.

“We began rolling out yesterday at 10% with full roll-out as we speak. We’ve seen an thrilling engagement because the information went reside 4 hours in the past,” Mian stated.

However there are different choices for ETH staking past the 2 suppliers MetaMask now presents via its platform. Coinbase, Binance US, Kraken, and Nexo additionally supply Ethereum staking, every with various rewards charges. Of these centralized suppliers, solely Coinbase and Nexo at the moment supply a liquid staking choice, returning Coinbase Wrapped Staked ETH (cbETH) tokens or Nexo Staked Ethereum (NETH) in change for ETH, respectively.

Solo staking can be an choice—however customers will want a minimal of 32 ETH (roughly $45,800) to take action.

Staking Advantages

As a result of Ethereum is a proof-of-stake blockchain, extra customers staking ETH and working validators across the globe will, in principle, make the community safer and decentralized over time. That’s a superb factor for the community, which has been criticized for being extra centralized when in comparison with Bitcoin.

Passive revenue via staking rewards may additionally seem to be a no brainer to some who’re long-term holders and don’t plan to instantly promote or commerce their luggage of ETH within the brief time period.

Staking Dangers

However locking up crypto with a 3rd celebration has its dangers. There’s a typical phrase in crypto: “Not your keys, not your cash.” And it has sadly rung true because the market offers with the devastating results of Terra’s crash and FTX’s meltdown. Even now, as Gemini shutters its “Earn” program following the collapses of crypto lenders BlockFi and Celsius, ought to holders ever belief their crypto with a 3rd celebration in any respect? What are the dangers, and what do Ethereum builders assume?

MetaMask father or mother agency ConsenSys defined in a put up final month what it believes to be the first dangers that include staking ETH. Particularly, it factors to potential dangers surrounding compromised third-party software program, buggy sensible contracts, and substantial token worth fluctuations.

It additionally raises the potential dangers related to undesirable governance choices made via any associated DAOs, points with code transfers, “authorized uncertainty,” and the opportunity of compromised non-public keys. Whereas which may seem to be a broad vary of potential dangers, each is feasible if the consumer compromises their very own information—or a robust third-party makes choices that change the foundations of the sport.

Staking Withdrawals

Earlier than contemplating staking Ethereum, it’s important to know that unstaking is not at the moment obtainable. Because of this proper now, your Ethereum can go in—however it can’t but come out. This may come as a shock to some, because it implies that staking is at the moment a one-way expertise, however Ethereum builders have plans to vary that very quickly.

The Shanghai replace slated for early this yr will allow staked ETH withdrawals.

“After the Shanghai replace, stakers will then be capable of withdraw their rewards and/or precept deposit from their validator stability in the event that they select,” the Ethereum Basis’s web site reads.

Ethereum developer Marius van der Wijden advised Decrypt that withdrawals may come as quickly as March.

“We’ve launched three withdrawal devnets and can do some withdrawal shadow forks quickly (the place we allow the characteristic on a shadow copy of the traditional Ethereum chain),” he advised Decrypt in a message. “Withdrawals are anticipated to go reside in March.”

As as to if Ethereum holders ought to stake their ETH or not, “folks ought to take heed to their intestine whether or not they wish to stake now or in a few months,” van der Wijden stated.

“The code for withdrawals is generally finished, however it nonetheless must be totally examined earlier than being rolled out,” he stated.

Keep on high of crypto information, get day by day updates in your inbox.

from Ethereum – My Blog https://ift.tt/mpLn1Bl

via IFTTT