Whereas many bitcoin buyers search for the asset to behave as a secure haven, bitcoin usually has finally acted because the riskiest of all threat allocations.

The beneath is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Brief-Time period Value Versus Lengthy-Time period Thesis

How bitcoin, the asset, will behave sooner or later versus the way it at the moment trades available in the market have confirmed to be drastically totally different from our long-term thesis. On this piece, we’re taking a deeper look into these risk-on correlations, and evaluating the returns and correlations throughout bitcoin and different asset courses.

Persistently, monitoring and analyzing these correlations can provide us a greater understanding if and when bitcoin has an actual decoupling second from its present development. We don’t imagine we’re in that interval in the present day, however count on that decoupling to be extra seemingly over the subsequent 5 years.

Macro Drives Correlations

For starters, we’re wanting on the correlations of one-day returns for bitcoin and lots of different belongings. Finally we wish to understand how bitcoin strikes relative to different main asset courses. There’s loads of narratives on what bitcoin is and what it may very well be, however that’s totally different from how the market trades it.

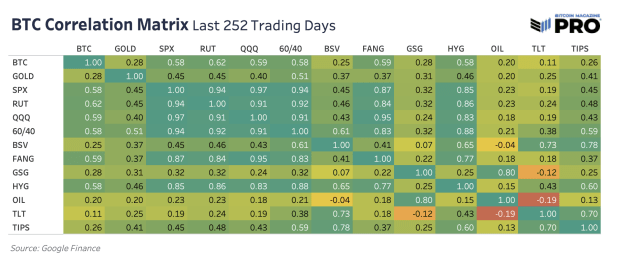

Correlations vary from destructive one to at least one and point out how sturdy of a relationship there’s between two variables, or asset returns in our case. Sometimes, a robust correlation is above 0.75 and a reasonable correlation is above 0.5. Larger correlations present that belongings are shifting in the identical path with the alternative being true for destructive or inverse correlations. Correlations of 0 point out a impartial place or no actual relationship. Taking a look at longer home windows of time provides a greater indication on the power of a relationship as a result of this removes short-term, risky adjustments.

What’s been essentially the most watched correlation with bitcoin over the past two years is its correlation with “risk-on” belongings. Evaluating bitcoin to conventional asset courses and indexes over the past yr or 252 buying and selling days, bitcoin is most correlated with many benchmarks of threat: S&P 500 Index, Russel 2000 (small cap shares), QQQ ETF, HYG Excessive Yield Company Bond ETF and the FANG Index (high-growth tech). In truth, many of those indexes have a robust correlation to one another and goes to point out simply how strongly correlated all belongings are on this present macroeconomic regime.

The desk beneath examine bitcoin to some key asset-class benchmarks throughout excessive beta, equities, oil and bonds.

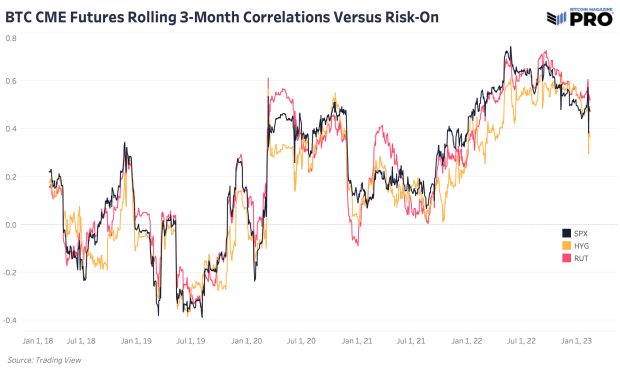

One other essential word is that spot bitcoin trades in a 24/7 market whereas these different belongings and indexes don’t. Correlations are seemingly understated right here as bitcoin has confirmed to guide broader risk-on or liquidity market strikes previously as a result of bitcoin might be traded at any time. As bitcoin’s CME futures market has grown, utilizing this futures information produces a much less risky view of correlation adjustments over time because it trades throughout the identical time limitations as conventional belongings.

Trying on the rolling 3-month correlations of bitcoin CME futures versus just a few of the risk-on indexes talked about above, all of them observe practically the identical.

Though bitcoin has had its personal, industry-wide capitulation and deleveraging occasion that rival many historic bottoming occasions we’ve seen previously, these relationships to conventional threat haven’t modified a lot.

Bitcoin has finally acted because the riskiest of all threat allocations and as a liquidity sponge, performing properly at any hints of increasing liquidity coming again into the market. It reverses with the slightest signal of rising equities volatility on this present market regime.

We do count on this dynamic to considerably change over time because the understanding and adoption of Bitcoin accelerates. This adoption is what we view because the uneven upside to how bitcoin trades in the present day versus the way it will commerce 5-10 years from now. Till then, bitcoin’s risk-on correlations stay the dominant market pressure within the short-term and are key to understanding its potential trajectory over the subsequent few months.

Learn the complete article right here.

Like this content material? Subscribe now to obtain PRO articles straight in your inbox.

Related Articles:

- A Rising Tide Lifts All Boats: Bitcoin, Threat Belongings Soar With Elevated World Liquidity

- The Every little thing Bubble: Markets At A Crossroads

- Simply How Huge Is The Every little thing Bubble?

- Not Your Common Recession: Unwinding The Largest Monetary Bubble In Historical past

- Brewing Rising Market Debt Crises

- Evaluating Bitcoin’s Threat-On Tendencies

- The Unfolding Sovereign Debt & Forex Disaster

from Bitcoin – My Blog https://ift.tt/gPTMYIl

via IFTTT