Silvergate purchasers flee as inventory value plummets and regulatory questions mount throughout the business. Choices for crypto banking companions are dwindling.

The article under is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Hassle Brewing In Crypto-Land

Developments round crypto on- and off-ramps have been heating up, as Federal Reserve Member Financial institution Silvergate Capital watched its depositors flee and its inventory value plummet. Together with Signature Financial institution, Silvergate is the opposite key U.S. financial institution that works carefully with the crypto sector.

The rationale for the acute focus of banking pursuits which can be keen to deal within the crypto sector is the final lack of regulation round know-your-customer and anti-money laundering (KYC/AML) coverage that exists within the business for offshore entities, in addition to the problems with the broader business being rife with unregistered safety choices and loads of fraud.

After all, we consider there’s a clear distinction between bitcoin and the broad time period colloquially known as “crypto”, however the strains stay blurred for a lot of regulators and authorities businesses.

Thus, there have traditionally been only a few entities within the regulated U.S. banking system which were keen to work with crypto corporations to entry established USD on- and off-ramps, which presents a novel problem to firms who’re within the enterprise of shifting cash and/or processing funds and transactions.

With reference to Silvergate, we’ve got been monitoring the state of affairs carefully since November — after the collapse of FTX — because it grew to become obvious that Silvergate performed a job in serving FTX and Alameda by giving them entry to USD rails.

As we wrote on November 17, (emphasis added):

“Who else is on the heart of many establishments out there? Silvergate Financial institution is a type of. Because the starting of November, their inventory is down almost 56%. Silvergate Financial institution is on the nexus of banking companies for all the business, servicing 1,677 digital asset prospects with $9.8 billion in digital asset deposits. FTX accounted for lower than 10% of deposits and the CEO has tried to reassure markets that their present mortgage e book has confronted zero losses or liquidations to date. Leveraged loans are collateralized with bitcoin that may be liquidated as mandatory. But, the continuing danger is a whole financial institution run on Silvergate deposits.. Though the CEO’s feedback sound reassuring, the inventory efficiency during the last two weeks inform a a lot totally different story.” — The Contagion Continues: Main Crypto Lender Genesis Is Subsequent On The Chopping Block

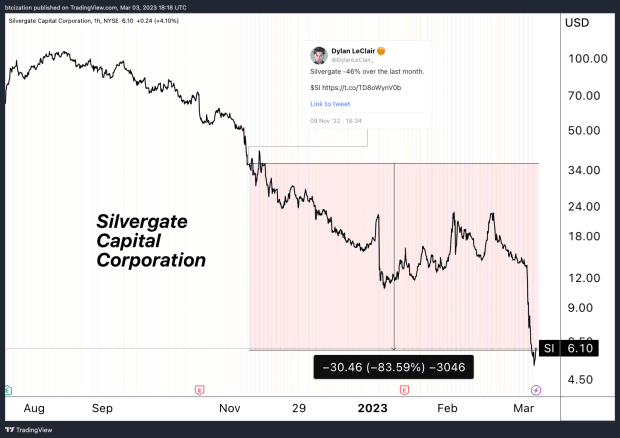

Because the implosion of FTX, shares of Silvergate Capital have fallen by 83%, placing the present drawdown from the all-time excessive value at an eye-watering 97.3%.

As referenced within the November 17 article, Silvergate’s share value isn’t imploding due the efficiency of a crypto token as was the case for a lot of firms within the crypto winter of 2022, however fairly from a deposit exodus that has compelled the agency to liquidate long-duration securities at a loss as a way to stay liquid.

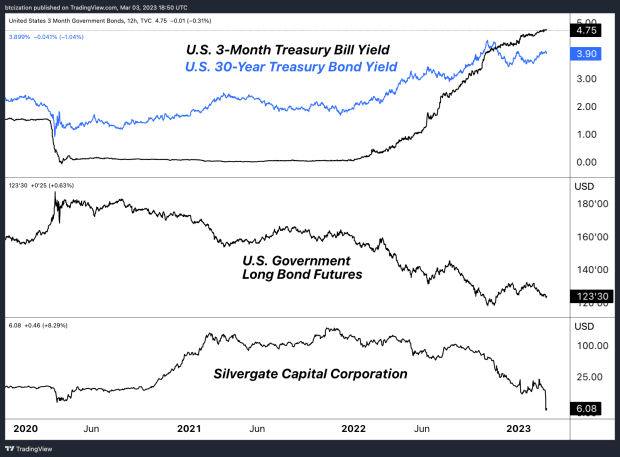

As a conventional fractional reserve financial institution, Silvergate took shopper deposits — which drastically elevated in 2021 — and lent them out over an extended length, into U.S. Treasury bonds, specifically. In observe, corporations would lend their cash to Silvergate by depositing at 0% as a way to make the most of their Silvergate Trade Community (SEN), and Silvergate would then lend out those self same {dollars} at a better rate of interest over an extended time frame. It is a nice enterprise mannequin — so long as your loans don’t fall in worth concurrently purchasers go to withdraw their funds.

“Clients withdrew about $8.1 billion of digital-asset deposits from the financial institution throughout the fourth quarter, which compelled it to promote securities and associated derivatives at a lack of $718 million, in response to an announcement Thursday.” — Silvergate Tumbles After FTX Implosion Prompts $8.1 Billion Financial institution Run

As commentary has ramped up concerning the incompetence and irresponsibility of Silvergate’s administration, we have to interpret among the nuance surrounding the state of affairs.

A majority of Silvergate’s deposits got here throughout a world of zero-interest-rate coverage, the place short-duration Treasury securities provided 0% yield. This phenomenon is among the core the reason why Silvergate invested in longer-duration devices. The bonds fell in worth as world rates of interest rose all through 2022.

With long-duration debt securities, cash isn’t misplaced within the case of rising rates of interest so long as the bond is held to maturity (and never defaulted upon), however within the case of Silvergate, fleeing deposits compelled the agency to comprehend the unrealized losses on their securities portfolio — a nightmare for a fractionally reserved establishment.

With solvency worries mounting in current months, firms frontran hypothesis about publicity to the financial institution, with names similar to Coinbase, Paxos, Circle, Galaxy Digital, CBOE and others speaking about their banking relations with Silvergate. Coinbase explicitly introduced their transfer to Signature financial institution.

“We’re facilitating fiat withdrawals and deposits utilizing Signature Financial institution, efficient instantly.” — Coinbase memo

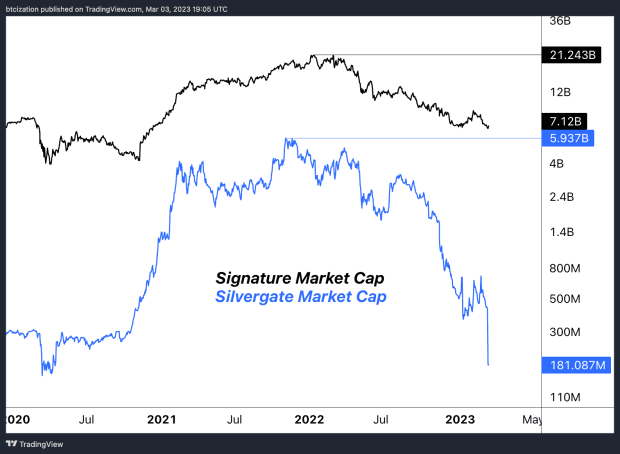

One concern is that many of those corporations are turning solely to Signature financial institution, which additional centralizes the off- and on-ramps at present utilized by the crypto business, although Signature has a a lot bigger market capitalization and extra diversified depositor base than Silvergate.

The present state of Signature’s digital asset deposit base is unknown, because the agency communicated its want to scale back reliance on crypto-related deposits in early December.

“Signature Financial institution (SBNY) will shrink its deposits tied to cryptocurrencies by $8 billion to $10 billion, signaling a transfer away from the digital asset business for the financial institution that till not too long ago had been probably the most crypto-friendly firms on Wall Avenue.

“We aren’t only a crypto financial institution and we would like that to come back throughout loud and clear,” Signature Financial institution’s CEO Joe DePaolo mentioned at an investor convention in New York hosted by Goldman Sachs Group on Tuesday.” — Coindesk

The timeline of those occasions is vital due to the current developments concerning the business’s flight from Silvergate coming on the identical time that Signature seems to be handcuffing the usage of its rails with key business gamers.

Ultimate Observe

Following a disastrous 2022, regulators are ramping up their cautious examination of the crypto sector, and one in all their primary targets is the connection between the business and the legacy banking system. As Silvergate seems to be to be all however useless within the water with almost each main business participant saying plans to sever ties, the growing reliance on Signature Financial institution, a financial institution that has introduced its intention to distance itself from the house, stays… worrisome.

Whereas this poses no elementary danger to the functioning of the Bitcoin community or its properties as an immutable settlement layer, the clampdown and growing centralization of USD on- and off-ramps is a key danger for short-to-intermediate time period liquidity within the bitcoin and broader crypto market.

Like this content material? Subscribe now to obtain PRO articles instantly in your inbox.

Related Previous Articles:

- The Larger They Are…

- The Trade Struggle: Binance Smells Blood As FTX/Alameda Rumors Mount

- Crypto In The Crosshairs & Bitcoin Futures

- Genesis Information For Chapter 11 Chapter, Owes Extra Than $3.5 Billion To Collectors

- Counterparty Danger Occurs Quick

- Collapsing Crypto Yield Choices Sign ‘Excessive Duress’

- The Crypto Contagion Intensifies: Who Else Is Swimming Bare?

- The Contagion Continues: Main Crypto Lender Genesis Is Subsequent On The Chopping Block

from Bitcoin – My Blog https://ift.tt/x0mEky5

via IFTTT