Unit of Account

Unit of account is the factor that measures the worth of products and companies. It is an important operate for one thing to be [or become?] cash. In easy phrases, it’s a customary measure of worth, a typical scaling system by way of which the worth of merchandise might be calculated and in contrast.

Nations usually have distinct models of account, recognized because the nationwide or regional foreign money, such because the euro (EUR) or the British pound (GBP). On the identical time, internationally, the U.S. greenback (USD) is the unit of account that’s primarily used for international invoicing and setting costs internationally.

Unit of account is considered one of cash’s three universally agreed capabilities of cash that Bitcoin Journal is reviewing; the opposite two are retailer of worth and medium of trade.

What’s a Unit of Account

A unit of account is no matter kinds the usual measure for evaluating costs with incomes or belongings; it permits cash customers to evaluate the worth of cash and is the widespread denomination for switch worth throughout various kinds of items and companies. When a unit of account is outlined by the identical measure or denomination (resembling a particular foreign money), it’s simpler to match the worth of assorted belongings and transactions.

Having a typical measure makes it simpler to find out the worth of two completely different objects, resembling the worth of a home and a automobile. Figuring out the automobile’s value and the home’s value makes budgeting and transactions simpler to evaluate.

It additionally permits us to course of mathematical operations, resembling calculating earnings, losses and revenue, giving numerical values to what we produce, commerce and devour.

Usually, what we determine as a unit of account is cash — in latest instances, backed by governments and nationwide currencies. It’s what we use as a typical measure for all our every day transactions.

Cash as a Unit of Account

Cash as a unit of account can also be used to measure a rustic’s economic system. For instance, the American economic system is measured in U.S. {dollars}, the Chinese language in yuan and so forth. Internationally, issues are typically simplified with the U.S. greenback as a unit of account, making it simpler to match completely different economies.

Cash is the usual measure utilized in economics and monetary markets to determine how a lot individuals can borrow or lend, and preserve monitor of their belongings’ worth. Relevant rates of interest are additionally calculated in the identical unit of account.

Lastly, cash can also be used to calculate the web price of people, companies and organizations of various sorts, together with the financial worth of their belongings.

Important Components of a Unit of Account

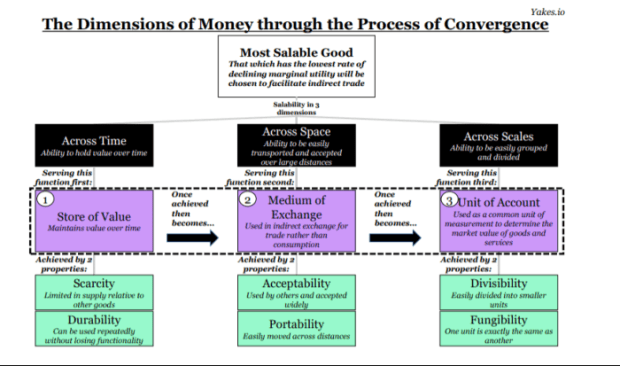

To achieve acceptance as cash by the market, a great usually goes by way of a three-stage course of: beginning as a retailer of worth, progressing to a medium of trade and at last turning into a unit of account to determine its quantifiable financial worth.

We’ve seen {that a} unit of account is used as a typical unit of measurement for the market worth of products and companies and to be salable. For a great to be outlined and credible as a unit of account, it will need to have the next properties:

Divisibility: As a unit of account, cash should be divisible into smaller models to facilitate transactions, specific the worth of products and companies extra precisely and successfully, and examine varied objects’ values extra simply.

Fungible: Fungibility is an important attribute of a unit of account and happens when two models of the identical foreign money are interchangeable. Therefore, the worth of 1 unit of account is equivalent to a different of the identical type. One greenback invoice, for example, has the identical worth as one other greenback invoice. Usually seen as a property of a medium of trade, its significance lies in its operate quite than its classification.

How Does Inflation Have an effect on the Unit of Account?

Inflation does not make the Unit of Account (UoA) operate worse; nonetheless, value instability does make it difficult to match the value of products and companies over time. The unit of account serves to facilitate the understanding of provide and demand dynamics within the economic system, however its reliability is severely eroded by inflation.

Because of this, market contributors might battle to make knowledgeable selections relating to consumption, investments and financial savings.

What Makes a Good Unit of Account?

Cash that’s divisible, and fungible makes a great unit of account. Cash not impacted by inflation would make a fair higher unit of account. Individuals typically argue that we should always have a sort of cash that is measurable, secure and fixed, just like the metric system.

If the unit of account was standardized just like the metric system, it might be a lot simpler to precisely and persistently assess the worth of products and companies over time. Nonetheless, worth is subjective and shifting, and the world’s circumstances differ over time, so there can’t be any assure that worth is all the time represented in the identical means.

Whereas we’ll by no means have a sort of cash that turns into as measurable because the metric system, we are able to have cash that has a preprogrammed, inelastic provide and is indifferent from the real-world worth of issues.

Bitcoin as a Unit of Account

If a sort of cash has the first properties mentioned, is accepted globally and can also be censorship resistant, it’s probably the perfect unit of account ever created.

Bitcoin, nonetheless, remains to be comparatively new and has quite a lot of maturing to do earlier than it may be acknowledged as a constant unit of account. Since Bitcoin has a set most provide of 21 million cash, it’s not topic to the identical inflationary pressures of conventional fiat currencies, which might be printed advert infinitum by central banks. This could present a degree of predictability and certainty for companies and people when assessing the worth of products and companies, making long-term monetary planning simpler and extra dependable.

Moreover, the dearth of inflationary pressures on the unit of account would additionally promote extra accountable financial decision-making by governments and companies. For the reason that temptation to print extra money to fund authorities packages or stimulate the economic system could be eliminated, policymakers must discover different methods to handle financial progress, resembling by way of innovation, productiveness and funding.

As well as, If bitcoin had been to develop into the worldwide reserve foreign money, it might promote higher worldwide commerce and funding by eliminating the necessity for foreign money exchanges and mitigating the danger of foreign money fluctuations. This is able to make it simpler and cheaper for people and companies to transact with each other throughout borders, facilitating higher financial cooperation and progress worldwide.

Total, a unit of account not impacted by inflation would supply a secure basis for the worldwide economic system, enabling companies and people to plan for the longer term extra confidently whereas selling extra accountable financial decision-making and worldwide commerce.

from Bitcoin – My Blog https://ift.tt/eshljYq

via IFTTT