That is an opinion editorial by Brad Mills, host of the Magic Web Cash Podcast and an investor in a number of Bitcoin-focused tasks.

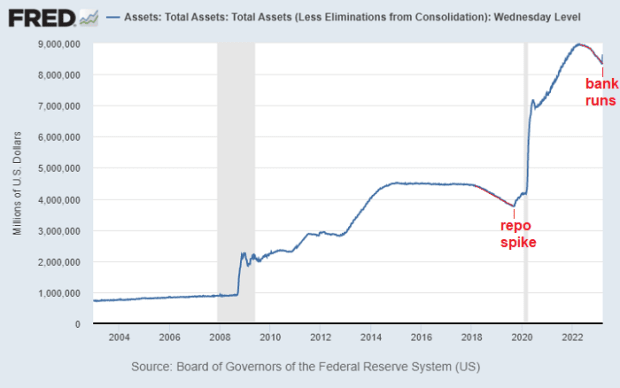

Huge banks are failing. Credit score Suisse, one of many largest globally-systemic necessary banks (G-SIBs) on the planet at $1.2 trillion in complete belongings, has just lately failed, requiring a bailout from the Swiss central financial institution.

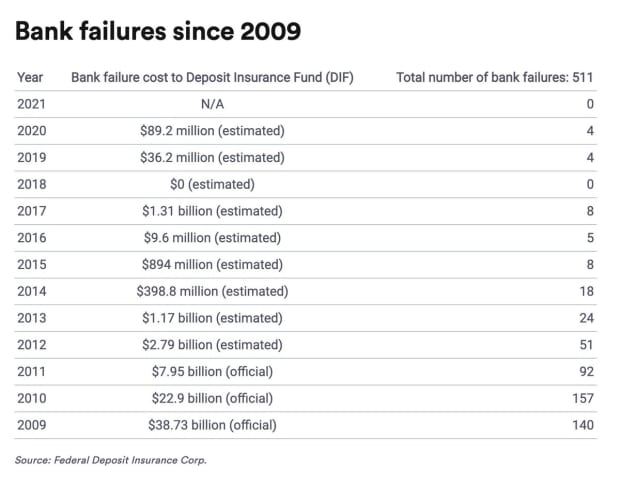

Earlier than the period of quantitative easing (QE), Time period Asset-Backed Securities Mortgage Facility (TARF) and Troubled Belongings Aid Program (TARP) bailouts, financial institution failures had been widespread. Permitting extra threat to flush from the system is a wholesome a part of free markets. Virtually 500 banks failed throughout the Nice Monetary Disaster (GFC).

Over the past decade of QE, barely any banks failed whereas economists, central bankers and politicians have been regularly and confidently assuring us that their stress checks are maintaining the banking system sound.

Is it a coincidence that over the past decade, as governments, central banks and business banks labored collectively to increase the cash provide sooner and better than ever earlier than in historical past, that banks stopped failing?

Have banks stopped failing over the past seven to eight years as a result of banks are safer and extra conservative, or is it as a result of report quantities of cash printing and authorities bailouts have moved the chance from financial institution stability sheets to elsewhere, merely delaying the inevitable?

Did transferring this threat from financial institution stability sheets to the central financial institution’s stability sheets by way of deficit spending, stimulus, QE and bailouts truly assist preserve your deposits safer, or has it truly precipitated wealth inequality to rise, debased the worth of your financial savings account and contributed to excessive inflation charges which makes the {dollars} in your financial institution price much less?

Lastly, in spite of everything of this, are we about to see a reversion to the imply of financial institution failures anyway? Is there a method to defend your self from the extremely-unlikely occasion of hyperinflation, or the more-likely occasion of a deflationary bust or continued excessive inflation attributable to governments printing cash to stop the collapse of the worldwide banking system and the lack of confidence within the foreign money itself?

Deposit Insurance coverage Turned Into A Confidence Recreation

Economists and policymakers cite Federal Deposit Insurance coverage Company (FDIC) and Canada Deposit Insurance coverage Company (CDIC) insurance coverage and post-GFC rules just like the Dodd-Frank Act and Basel III stress checks to assuage our considerations, telling us that the banks are wholesome and that the banking system is sound.

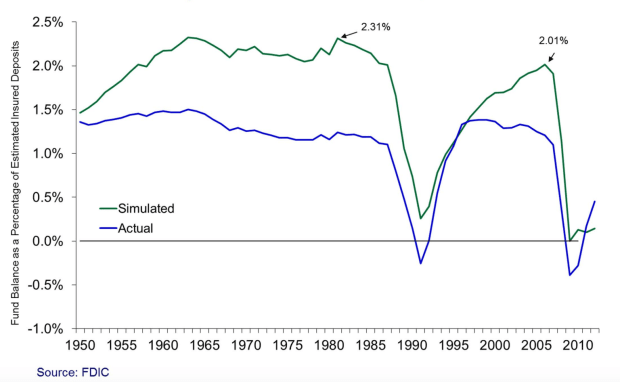

The truth is that the insurance coverage fund is woefully undercapitalized to cowl massive financial institution failures.

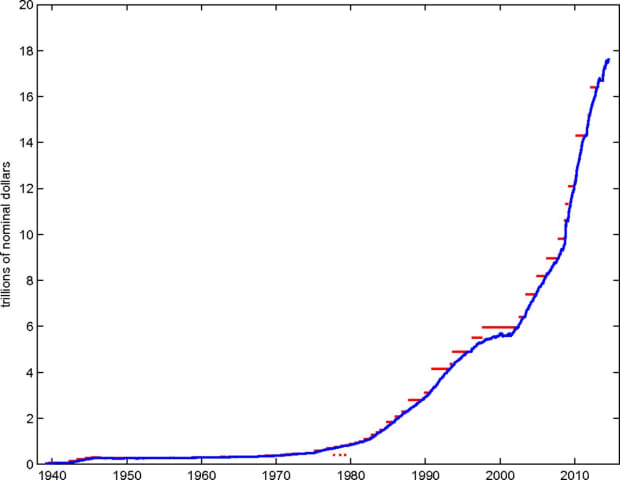

Within the U.S., there’s greater than $18 trillion in deposits and solely about $125 billion within the FDIC fund. Warren Buffet’s Berkshire Hathaway has extra money than the FDIC.

FDIC insurance coverage was put into place in 1933 throughout the Nice Despair as a approach to supply confidence within the banking system. So much has modified since 1933. The cash provide was once constrained by the quantity of gold that was backing {dollars}. There was nonetheless fractional-reserve lending, but it surely was much more conservative again then.

Whereas we had been on a sound cash commonplace, it was believable that the FDIC and CDIC may act as a reliable insurance coverage coverage for depositors, when coupled with sturdy financial institution rules and balanced budgets.

Nonetheless, the FDIC’s reserves have did not sustain with the expansion within the cash provide, and it has needed to be bailed out in some kind or one other throughout the Nineties, in 2008 and 2009 and, most just lately, with the most recent spherical of financial institution failures.

Deposit insurance coverage is simply one other technique within the confidence sport designed to distract you from discovering the fact of how cash and banking work.

Addressing Fractional Reserve Banking And The ‘Cash Multiplier’

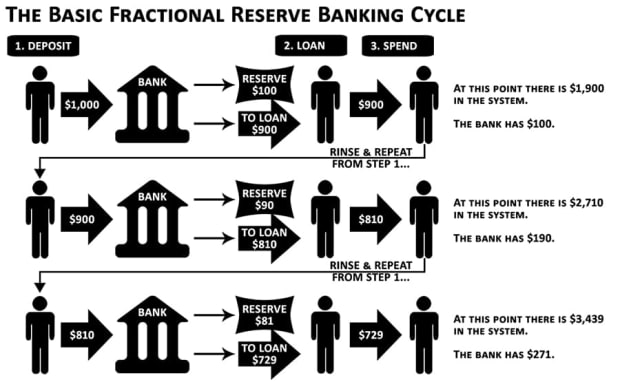

Many suppose that we function on a fractional-reserve financial institution system that allows the “cash multiplier,” however this can be a widespread false impression as banks don’t function on that system anymore. Banks actually have the license to print cash from nothing and the “cash multiplier” is a fantasy.

You will have seen fractional-reserve banking and the cash multiplier described because the financial institution maintaining 10% of your deposit as reserves and lending the remaining out, then repeating that course of till the unique deposit is multiplied upwards of ten occasions.

Whenever you deposit $1,000 into the financial institution, there isn’t a formulation that claims the financial institution retains 10% of that as reserves after which it might mortgage $900 to another person, repeating this advert nauseum till $1,000 turns into $10,000.

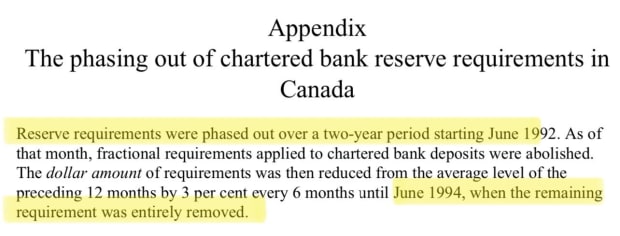

In actuality, it’s “fictional reserve” banking, as a result of the cash lent out by banks is just not backed by something tangible and the debt that the federal government points regularly expands. The nationwide debt won’t ever be paid off and the banks haven’t any reserve necessities anymore.

Many sensible individuals reject this framing. They’ll’t settle for that that is how the financial system works.

Don’t really feel dangerous for those who’re confused about these things. It’s an opaque course of designed to obfuscate the fact of how the buying energy of cash will at all times be debased.

The fashionable banking system is like a pc working system the place a small group of individuals have root-level administrator entry, they usually give a bunch of their mates a god mode cheat code.

The truth is that “BankOS” has been architected as a system of management and a wealth switch mechanism from the underside to the highest… and also you’re most likely not on the high.

Many sensible individuals who imagine they perceive the banking system are confused about how banks difficulty loans, they imagine that banks conservatively difficulty new loans primarily based on the quantity of deposits they’ve. They imagine that as buyer deposits develop, banks lend that cash out, and because the cash needed to exist to ensure that the financial institution to lend it out, the banks didn’t print the cash.

It is a naive understanding, and it doesn’t serve your pursuits to imagine on this fairytale.

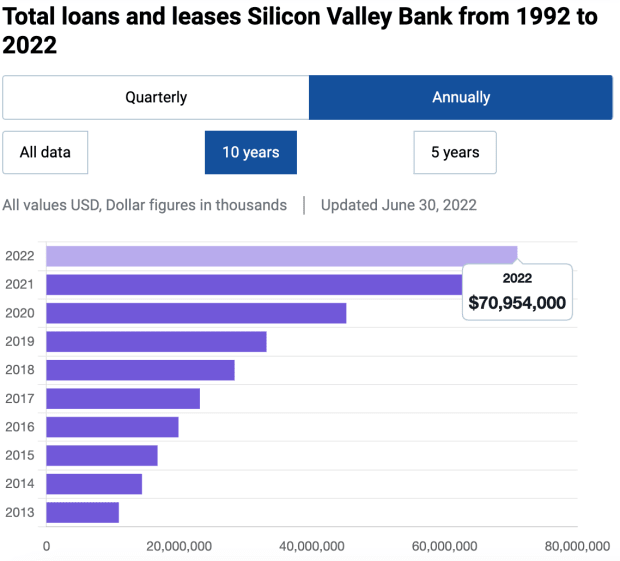

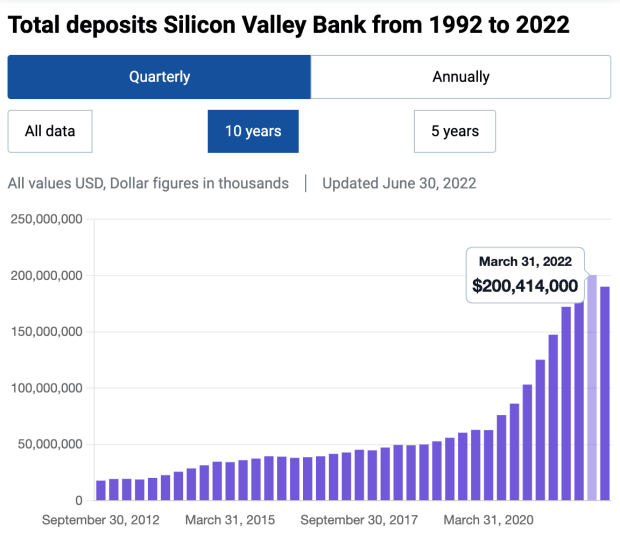

Let’s take Silicon Valley Financial institution (SVB), for instance, the third-largest financial institution to break down in U.S. historical past.

My sensible mates will take a look at the above graphs and say, “See, Silicon Valley Financial institution didn’t simply generate income from nothing; they acquired numerous new deposits over time and loaned out these deposits!”

They may see that the financial institution ended with about $200 billion in deposits and about $70 billion in loans and mistakenly suppose that the financial institution was conservatively lending current cash, not creating new cash.

However the hard-to-accept actuality is that the incoming deposits had been truly created when a financial institution made a mortgage.

Perhaps it was Silicon Valley Financial institution that created the deposits from nothing, possibly it was one other financial institution — however the majority of the “deposits” within the banking system are created from nothing by banks.

My sensible mates will say, “This is not sensible, if banks can create cash from nothing, why wouldn’t they only regularly print cash to make limitless earnings?”

The reality is, if you take a look at the expansion of the cash provide, that’s what they do.

So long as there’s demand for borrowing, banks will lend. They’ve a license to print the cash and a license to cost usurious ranges of curiosity on the cash.

It’s a marvel why banks fail in any respect underneath a system the place they’ve a license to increase the cash provide by means of issuing loans, constrained primarily by our demand for borrowing and what they deem your “creditworthiness” to be.

A lot of the “cash” within the system is definitely simply created from nothing this manner by banks — and as icing on the cake, if you deposit this created-from-nothing-by a financial institution “cash” right into a financial institution, in addition they take your deposits and make investments them within the treasury market or deposit them to the central financial institution as financial institution reserves to make much more earnings.

The second that you just deposit cash right into a checking account, it turns into a legal responsibility on the financial institution’s stability sheet and is now not “your cash.”

Financial institution rules are a part of the arrogance sport, designed to stop financial institution runs by depositors. In March 2020, the reserve necessities for U.S. banks had been lifted, and plenty of British Commonwealth nations have been on a zero-reserve requirement regulatory scheme for 20 to 30 years.

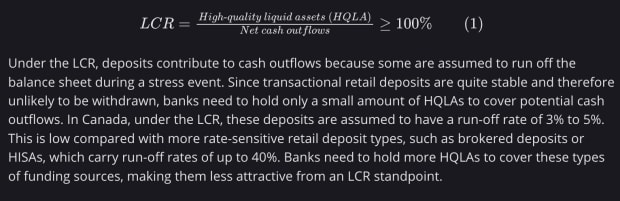

As an alternative of 8% to 12% reserve necessities, there are numerous liquidity and collateral guidelines that banks are urged to comply with. Certainly one of these guidelines is the liquidity protection ratio, or LCR.

LCR is necessary relating to financial institution runs, which is what we’re seeing occur now throughout the worldwide banking system.

With the intention to go regulatory stress checks, banks should preserve a portion of their reserves in high-quality liquid belongings (HQLA) which embody money and cash-like devices similar to authorities bonds that may be shortly bought to satisfy buyer withdrawals.

Banks should at all times have sufficient high-quality liquid belongings as a way to meet 30 days of anticipated web outflows and buyer withdrawals.

The Financial institution of Canada assumes that buyer deposits within the nation’s ”Huge Six” banks are very sticky, so it solely assigns a run-off price of three% to five% and these banks will not be required to maintain important HQLAs to cowl deposits.

The issue arises when there’s a systemic disaster in both the banking system or the cash itself that causes concern and panic, driving individuals to withdraw their cash bodily or wire it out digitally.

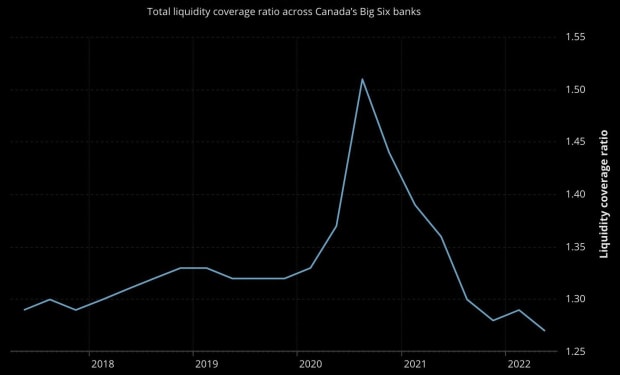

In 2022, when Canada Prime Minister Justin Trudeau and Deputy Prime Minister Chrystia Freeland invoked the Emergencies Act and threatened to freeze the financial institution accounts of anybody concerned in or supporting the Freedom Convoy, this precipitated a run on the Canadian banks, as proven by the LCR chart under.

This sudden shock and erosion of belief within the Canadian banking system from a big sufficient share of the inhabitants precipitated the LCR of Canada’s largest banks to drop considerably.

When a financial institution run occurs, 30 days’ price of anticipated web outflows is perhaps taken out in someday, leaving the financial institution doubtlessly bancrupt if there are liquidity points with the high-quality liquid belongings the financial institution makes use of for its HQLA reserves.

‘Too Huge To Fail’: How The Present Financial institution Failures Are Not Like 2008

So, now that we all know that the cash multiplier is a fantasy and banks are literally allowed to create credit score (cash) from nothing by way of fictional-reserve banking, approved by the central financial institution, let’s proceed!

Why did we not see any indicators of financial institution failures over the past 10 years till now?

It seems that the central bankers saved rates of interest close to zero whereas they recapitalized banks and monetized report authorities debt issuance (deficit spending) to the tune of trillions of {dollars}. In that setting, banks look like wholesome.

If the federal government gave you a cash printer, I’m certain your funds could be much more sound as nicely!

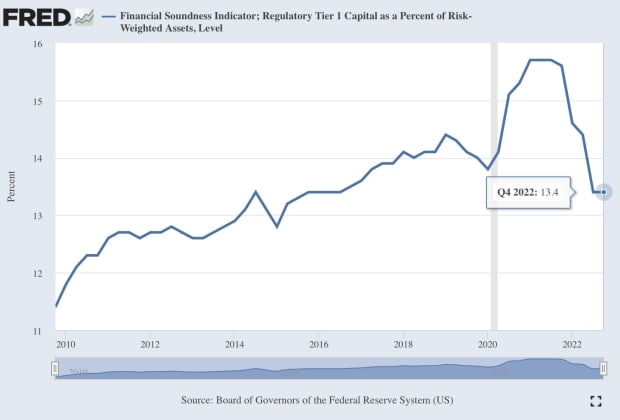

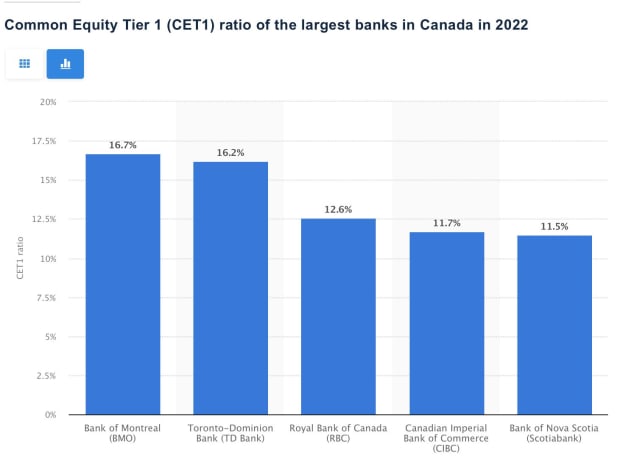

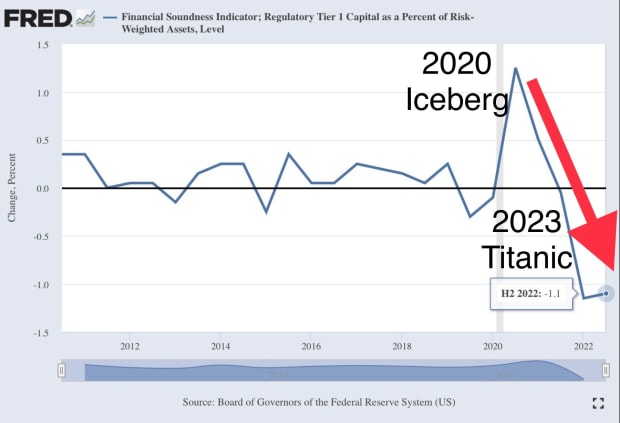

There’s a “monetary soundness” indicator that the central banks use often called a Frequent Fairness Tier 1 (CET1) ratio, which is also called a capital buffer.

Within the chart under, due to QE and different bailout applications, you possibly can see that the soundness of the banks elevated till just lately, after we noticed the biggest share drop of CET1 since they began measuring it.

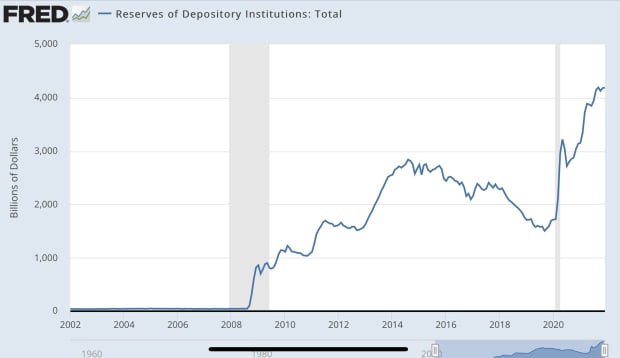

U.S. banks went from having almost zero extra reserves pre-2008, to being regularly injected with tons of of billions per yr by way of bailouts and QE till the full reserves parked on the Federal Reserve peaked at an astronomical $4 trillion just lately.

The final banking disaster was brought on by an excessive amount of actual property hypothesis by the general public and an excessive amount of poisonous, derivative-risk taking by huge banks.

The large banks had been deemed “too huge to fail.” With the intention to save the flawed system, they threw out the thought of being fiscally conservative and began normalizing bailouts as the primary resort.

We’re 50 years into the backed-by-nothing U.S. greenback experiment and almost 15 years into this infinite, reserve-banking, central-planning experiment, and it appears like the whole lot is damaged, particularly the buying energy of greenback savers.

An excessive amount of centralization and interference in monetary markets to save lots of the “too huge to fail” banks has proven up as an acceleration of the perversion of incentives within the economic system.

The position of the greenback went from being a financial savings car — work exhausting and save your cash — to a system of management and wealth redistribution from the underside to the highest — work exhausting and spend your cash.

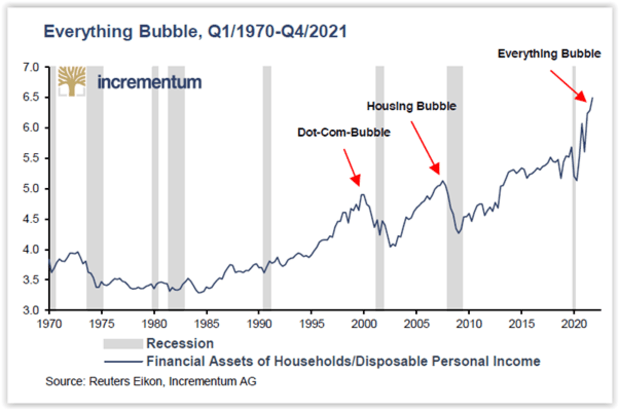

Because of this new ‘too huge to fail’ experiment, we’ve seen the rise of the “the whole lot bubble,” which makes this disaster a lot completely different than the final one. The present disaster is a disaster of confidence within the cash itself and all the banking system, not essentially something that the banks did.

How Did Governments And Central Banks Trigger The Every part Bubble?

Rates of interest had been held artificially low throughout this time period. With the central bankers signaling that charges could be held decrease for longer, this inspired over borrowing and extreme threat taking by banks, companies and residents.

Mix this poor central banking coverage with gluttonous authorities deficit spending and we see the full provide of cash rise exponentially.

Whenever you add within the provide chain disruptions from the “finish of the age of abundance” as French president Davos aficionado Emmanuel Macron just lately warned about — all of this has precipitated inflation to rise sooner than my technology has seen in our lifetimes.

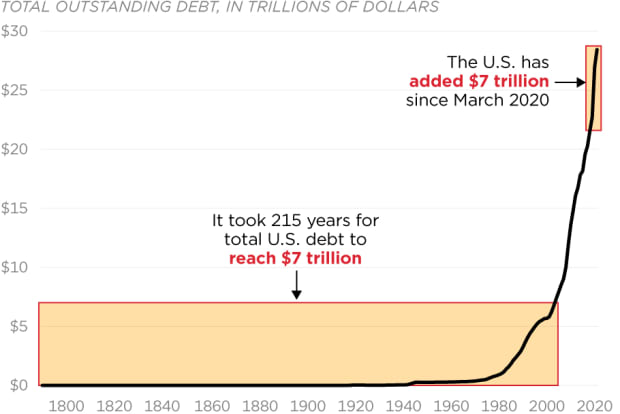

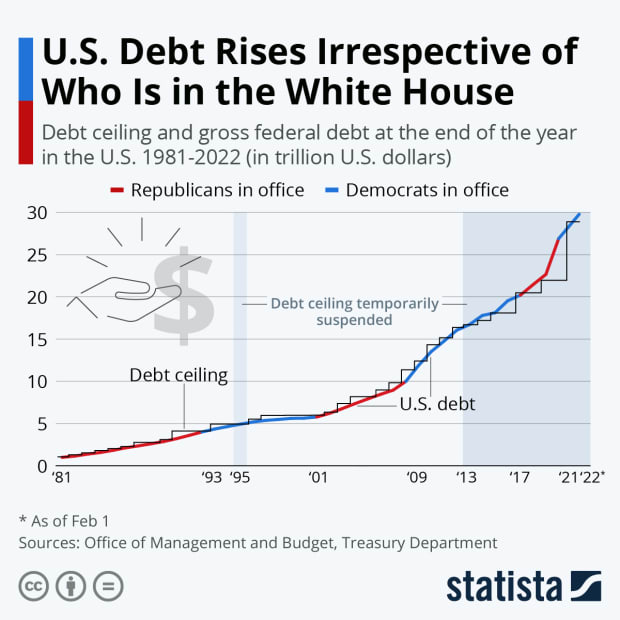

The U.S.’s nationwide debt elevated from a staggering $10 trillion to a mind-numbing $30 trillion because the 2008 to 2009 GFC.

The cash provide has inflated massively. It took the U.S. two centuries to accrue $7 trillion in nationwide debt till just lately, when $7 trillion was added in simply one other two years!

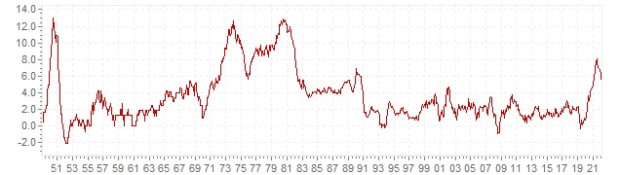

Worth inflation is the very best it’s been in many years.

Labor participation is the bottom it’s been in many years.

Wealth inequality is regularly going within the improper route since 1971 and has accelerated throughout the QE interval.

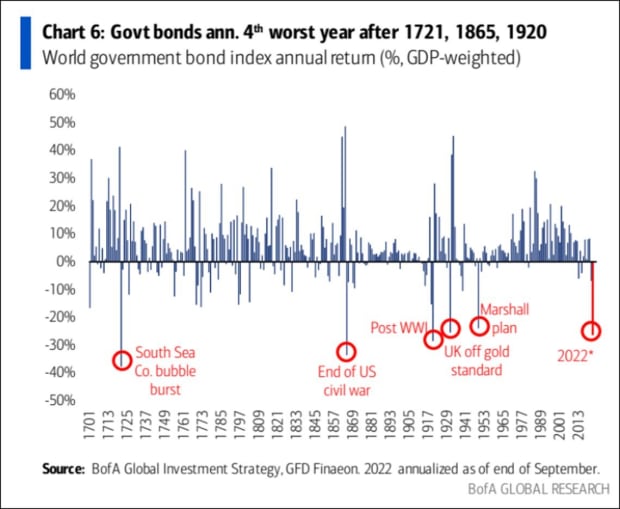

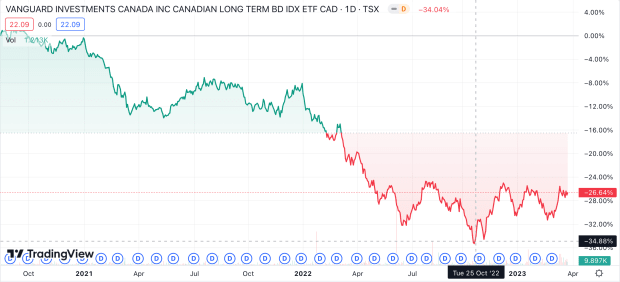

The bond markets are extra unstable now than they’ve been in many years, and 2022 was the worst yr for shares and bonds since 1920.

The ballooning of the cash provide and progress of the debt-based financial system is just not a left versus proper phenomenon — at the least in America — each side have presided over the destruction of the greenback’s buying energy and the weakening of the banking system.

What Does Historical past Inform Us About What Would possibly Come Subsequent?

It’s very tough to have a look at the previous and work out which interval of historical past that is most like.

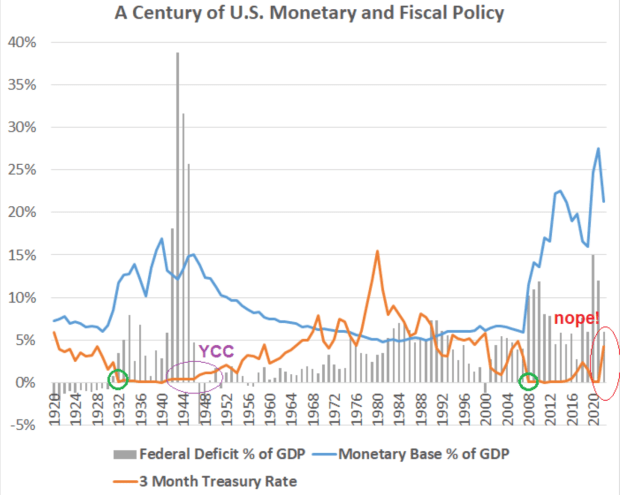

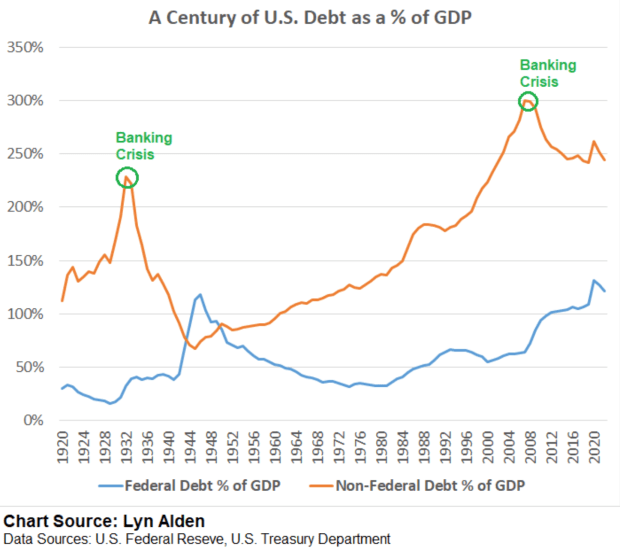

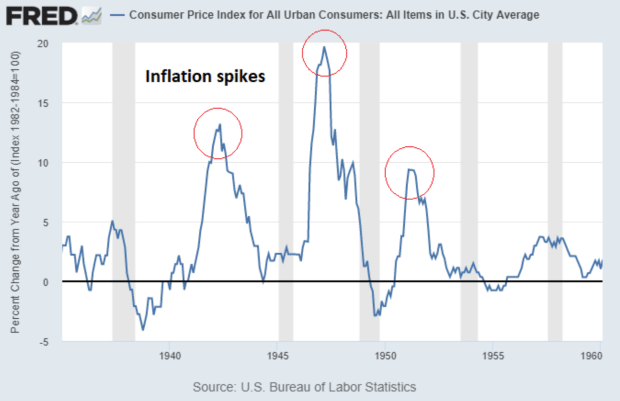

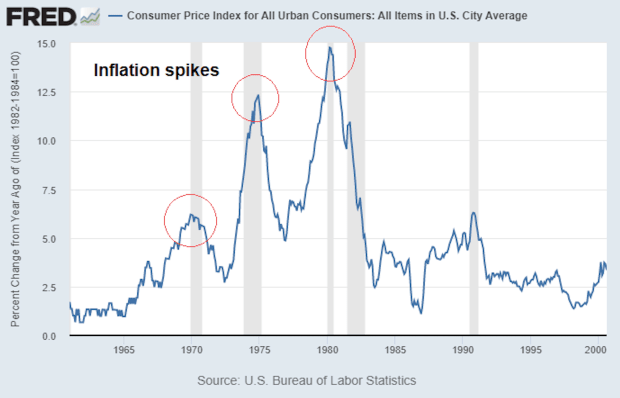

Impartial analyst Lyn Alden has identified that for those who take a really long run view of the economic system and the monetary system, essentially the most related time frame to check this to is the Nineteen Thirties and Forties.

For the reason that greenback has misplaced almost 97% of its buying energy over the past 100 years, and the provision of cash has modified by orders of magnitudes, she’s devised a proxy measuring stick of utilizing share of GDP.

Other than Forties-style inflation, one other correlation to that point interval is the explosive progress within the debt-to-GDP ratio that we presently face in comparison with what it was throughout World Struggle II.

Yield Curve Management (YCC) is principally when a central financial institution must intervene with the bond markets to control the rate of interest by mandate, fairly than letting the free market type it out.

Alden factors out that, just like the Nineteen Thirties, in 2003 rates of interest had been minimize to 1%, which precipitated banks and residents to tackle numerous debt and threat. Then, in 2004 to 2006, the charges had been jacked up, which precipitated the housing disaster that surfaced a number of years later — resulting in the banking disaster.

The can was kicked down the street till 2020 to 2021, when rates of interest had been minimize all the way in which to zero whereas central bankers had been printing cash and conducting QE.

In 2022 to 2023, the charges had been jacked up, inflicting the present banking disaster.

Alden additionally factors out that within the Forties in addition to within the Nineteen Seventies, inflation got here in waves, and he or she expects the identical to occur over the subsequent decade.

In January 2022, throughout a Home of Commons of Canada session, Conservative Social gathering Pierre Poilievre Chief gave a speech on the historical past of cash, educating fellow MPs concerning the follies of cash printing and the way it causes inflation:

“Now we have not been proof against this inflationary illness. Within the post-war period, we inherited monstrous money owed combating the fascists. We principally operated on an American-led commonplace whereby you could possibly trade a U.S. dollar at a price of $35 per ounce in gold.”

Poilievre continued speaking concerning the prosperity we had within the post-war period underneath the gold commonplace:

“Right here in Canada, with stable foreign money, we wrestled the inflationary beast to the bottom. We paid off our report warfare money owed, we elevated the dimensions of the Canadian economic system by 300%, and by 1973 we had principally turn out to be a debt-free nation.”

“Then what occurred within the Nineteen Seventies?” he continued. “President Nixon needed to spend on warfare and welfare. In fact, the People had been slowed down in Vietnam, which was expensive an enterprise. President Nixon needed to maintain his recognition at residence, so he determined to spend, spend, spend… Within the decade that adopted 1971, not solely did they unleash the American greenback from a sound cash commonplace, however they elevated the variety of U.S. {dollars} in circulation by 150% whereas output solely grew by 39%. In different phrases, the sum of money grew about four-times sooner than the quantity of underlying output that that cash represented.”

This subsequent half will get a bit partisan, but it surely’s very related to what we’re experiencing now.

Poilievre continued, “Right here in Canada, we had Pierre Elliot Trudeau as prime minister. He seemed down in any respect the inflation that the U.S. authorities was creating — they’d reached double-digit inflation, a complete inflationary disaster.

“The American greenback was devalued on a world foundation, incapable of shopping for inexpensive petroleum on the world market … poverty was overtaking inner-city streets and the wealth hole was increasing in america of America.

“What did Pierre Elliot Trudeau do? He began printing cash right here in Canada, massively growing the cash provide. Between 1971 and 1981, the cash provide in Canada grew by over 200% whereas GDP solely grew in actual phrases by about 47%.

“So you possibly can think about when cash is rising in provide at greater than 4 occasions the speed because the economic system is rising, you might have extra {dollars} chasing fewer items, and what do you get?”

Inflation.

Why Deflation Is Good And Costs Ought to Come Down, If It Weren’t For Central Banks And Politicians

Not solely are we coping with government-induced inflation, however we’re additionally now affected by their proposed answer to inflation: jacking up the rates of interest and crushing everybody financially.

The banking disaster was by no means absolutely handled in 2008 and 2009.

As an alternative of taking a decade of ache, permitting charges to naturally rise whereas over-leveraged, massive banks failed and poorly run companies went underneath, they determined to socialize the losses and privatize the beneficial properties.

Not solely was the can kicked down the street, however central bankers and economists tried to promote us on being frightened of deflation!

They had been attempting to rationalize their financial machinations as a method to cease costs from dropping, attempting to concern monger and persuade all of us that decrease costs is a foul factor.

In Jeff Sales space’s guide “The Worth of Tomorrow,” he describes how expertise is deflationary. If we had a sound cash like Poilievre described, it could make sense that technological developments and productiveness beneficial properties would trigger costs to drop.

With a extra sound cash that doesn’t regularly inflate like our present debt-based, damaged cash system, your buying energy wouldn’t decline over time and we’d benefit from the deflationary advantages of expertise.

With deflation and a extra sound financial system, you could possibly reside a dignified life and afford a house on a smaller wage as costs naturally come down.

Critics of sound cash will say that underneath the gold commonplace we noticed booms and busts, and you may’t get out of an financial melancholy with out inflating the cash provide.

There isn’t a straightforward reply right here, and the answer might be one thing within the center, at the least throughout a transitory part. We have to slowly transition to a sound cash system whereas additionally growing monetary literacy.

Critics of sound cash techniques like a gold-backed commonplace too usually depend on a false dichotomy argument, the place it needs to be both steady stimulus or international melancholy with nothing within the center.

One thing has to alter — it’s clear that the debt-based, money-printing, stimulus-by-default system we’ve been working on has seen continuous growth of the wealth hole. In actual fact, it’s believable to have a interval of transition the place you could possibly assist the underside 50% out with a type of common fundamental revenue, when you improve monetary literacy and encourage saving in a tough cash.

You could possibly do that whereas eliminating a number of extreme federal spending, and transitioning to a extra sound financial system over a interval of 5 to fifteen years, all whereas we take pleasure in the advantages of expertise making our lives higher!

Politicians, mainstream economists and central bankers are combating the deflationary advantages of expertise by arbitrarily concentrating on 2% inflation and regularly growing the provision of cash by way of numerous strategies like authorities deficit spending, business financial institution credit score creation and central financial institution cash printing.

Since these economists and bankers had been claiming that QE and stimulus didn’t trigger inflation, they had been concern mongering a few “deflationary spiral,” attempting to create the political will for the subsequent spherical of cash printing to maintain their inflation experiment going… and, predictably, they overreacted and gave us an inflationary disaster as an alternative of a deflationary one.

Governments Trigger Inflation And Inflate Asset Bubbles With QE

Canada’s central bankers comply with the consensus of the remainder of the G20 nations, particularly the U.S.

Like most G20 nations, the Canadian authorities can’t finance deficit spending with out issuing debt.

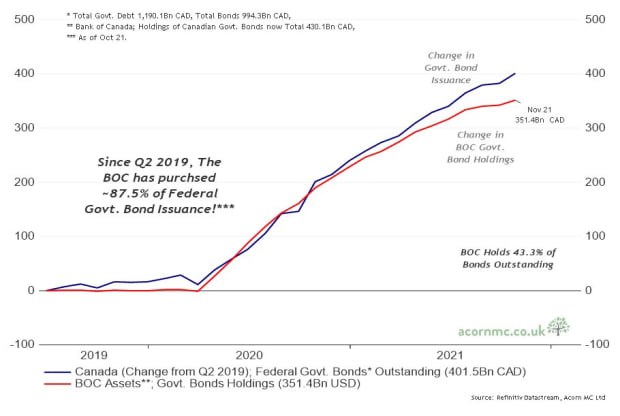

Since there was not enough demand to buy the newly-issued debt (bonds), Trudeau and Freeland labored in lockstep with Financial institution of Canada Governor Tiff Macklem — basically directing the Financial institution of Canada — to purchase long-term debt from the federal government (by way of the banks) to artificially manipulate the charges as near zero as they may get it. They name this QE.

Shockingly, starting in 2019, the Financial institution of Canada has bought an abnormally-high share of all Canadian authorities bonds issued, which has enabled the Trudeau authorities to disregard free market impulses and put the nation into historic debt ranges.

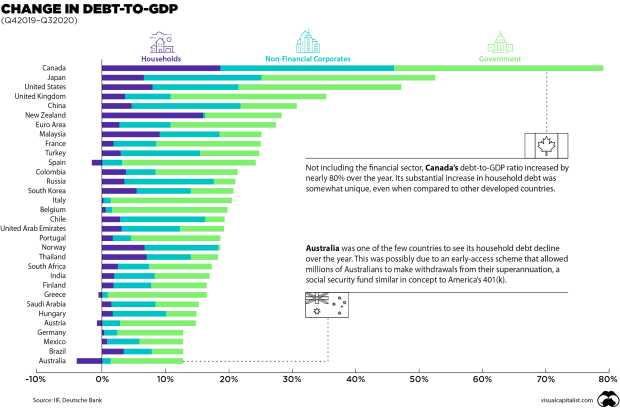

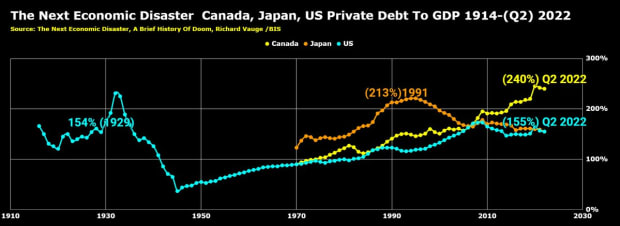

Canada’s private and non-private debt-to-GDP expanded a lot sooner than every other G20 nation at the beginning of 2020.

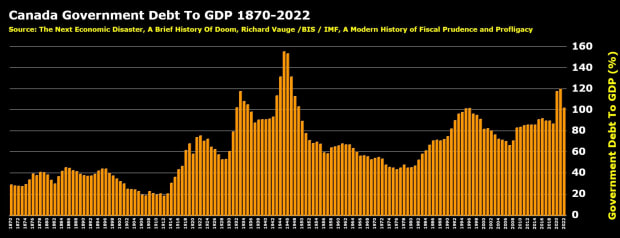

That pattern continued till only in the near past, when our complete debt-to-GDP started to look extra like the height of the U.S.’s debt-to-GDP ratio within the Forties throughout World Struggle II.

Bear in mind: this consists of public debt (federal and provincial authorities deficit spending and liabilities) and public debt (company and family debt).

From Canadian macroeconomic forecaster Joseph Barbuto, aka Financial LongWave, here’s what Canada’s historic debt-to-GDP appears like over the past century (we’ve to return to the Nineteen Thirties to see the final time our public debt-to GDP ratio was this excessive):

A part of the reasoning behind this huge deficit spending was that Freeland and Macklem had been each blindsided by inflation, together with all of their G8 cash grasp friends, concern mongering about deflation as just lately as October 2020.

In August 2022, after the value of houses, investments and different fascinating objects had caught as much as the entire newly-issued cash and inflation soared to the very best it’s been in many years, Freeland, Macklem and the Financial institution of Canada had been attempting to regulate the narrative round inflation.

They launched an announcement claiming that they didn’t trigger inflation by “printing cash,” and shifted the blame utilizing the “everybody else is doing it” protection whereas advising companies to not improve wages in response to rising costs.

Jesse Berger, a Canadian writer targeted on financial coverage, commented, “Earlier this month the Financial institution of Canada blamed you for inflation and advised you to not give raises regardless of awarding themselves $45 million in bonuses.”

He continued, “The place did they get the funds to purchase bonds? They did not ‘print money’ per se, they only used a ‘sort of central financial institution reserve’ factor. No bodily notes means it isn’t actually ‘printed money.’ So it is a figurative lie, not a technical one.”

That is how they attempt to confuse what they’re doing with difficult phrases like “quantitative easing” and obfuscate what cash is by labeling the cash they create throughout QE as “central financial institution reserves.”

Nonetheless, in November 2022, Macklem testified that the Financial institution of Canada ought to have began tightening charges sooner and Authorities spending contributed to inflation.

What Is QE? Quantitative Easing, Demystified

Poilievre spoke at a rally concerning the results of quantitative easing on the cash provide, inflation and rates of interest in Canada.

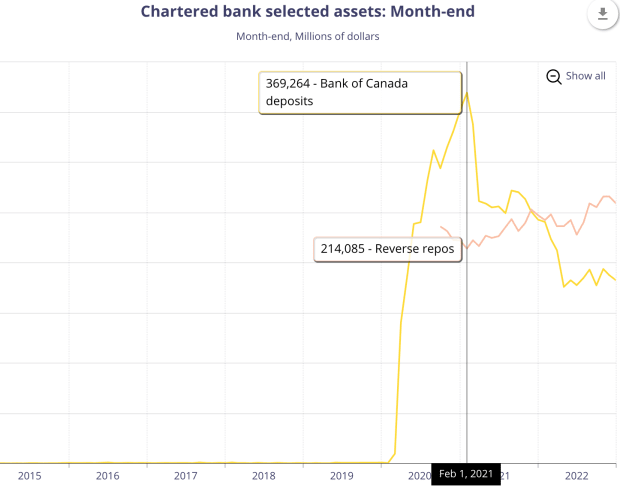

Cogently explaining how the central financial institution pays to purchase the bonds from the federal government, he stated, “Nicely, it deposits cash within the monetary establishments’ accounts held on the Financial institution of Canada. The deposits for these monetary establishments skyrocketed to about $300 Billion from nearly nothing inside a few years.”

He continued, “These deposits will be was exhausting paper money. That’s the reason the cash provide went from $1.8 trillion to $2.3 trillion — half a trillion {dollars}, which is sort of precisely what the deficit was — not a coincidence.

“The paper cash — the stuff that’s printed — went from $90 billion to $124 billion. Each elevated by roughly 27% in a number of years.

“The cash that’s nonetheless on deposit with the central financial institution has created a brand new downside. The central financial institution purchased bonds with yields of 0.25% and paid for it with deposits on which it now has to pay 4.5% — in different phrases, they’re now dropping cash on the unfold.

“For the primary time in historical past, the Central Financial institution of Canada wants a bailout of $4 billion a yr. That doesn’t think about any further losses that may occur in the event that they finally promote these bonds that are price much less now than once they purchased them.”

“This has been superb for the very rich as a result of along with arbitraging these transactions, this inflationary coverage drove up asset costs,” Poilievre continued. “In case you have a $10 million mansion and home costs go up by 50%, you’ve simply made $5 million tax free. In the event you’re the brand new immigrant who doesn’t personal any property, the buying energy of your greenback by way of actual property has simply gone dramatically down.”

Poilievre punctuated his lesson on how QE creates wealth inequality by saying it’s “a large wealth switch from the have-nots to the have-yachts.”

Fast Evaluation So Far

At this level, l’d wish to recap and add some extra components to the dialogue so we will proceed understanding why many banks are technically bancrupt and beginning to fail:

- Central bankers held rates of interest too low and signaled to everybody, together with the banks, that they may proceed to maintain charges low to keep away from deflation, selling the flawed logic of “inflation is transitory” and “deflation is dangerous.”

- Banks don’t function on a reserve system anymore — as an alternative they regularly create debt cash by means of credit score issuance and are inspired to carry high-quality liquid belongings, similar to authorities bonds and mortgage-backed securities, to guard towards financial institution runs in case everybody discovers there will not be satisfactory reserves for everybody to get their cash out.

- Governments inflated the cash provide with huge stimulus and deficit spending. Central Banks enabled the large deficit spending with QE.

- QE by itself didn’t immediately add new cash to the system, although the central financial institution created the reserves from nothing — as a result of banks used current cash (our deposits!) to purchase the bonds which they bought to the central banks.

- The G7 made a tough determination to drop a nuclear bomb on the monetary system by sanctioning Russia, placing contagion stress on European and different Western banks.

- Central banks began elevating charges sooner than they ever have earlier than in historical past to fight inflation, deflating the bond bubble and inflicting banks to turn out to be bancrupt.

As Poilievre talked about in his rebuke of QE, central banks may understand losses if they’re pressured to promote bonds.

Nonetheless, a good rebuttal to this argument is that central banks don’t should promote their bonds — they may possible maintain them for years or many years to maturity and never understand any losses in greenback phrases as a result of they’ll create the {dollars}.

(This is the reason they declare that the bonds are “threat free.” Whereas it’s true that they’re threat free when denominated within the foreign money, they aren’t threat free when measured in buying energy.)

In contrast to central banks, common banks are in a precarious place the place they should promote underwater bonds as depositors withdraw report quantities of cash.

Because of this exodus from the banking system, they’re now not in a position to cover the issue with accounting tips. The depositor runs are forcing banks to understand the large losses that had been hidden with held-to-maturity (HTM) accounting fairly than fair-value accounting of their underwater bond portfolios.

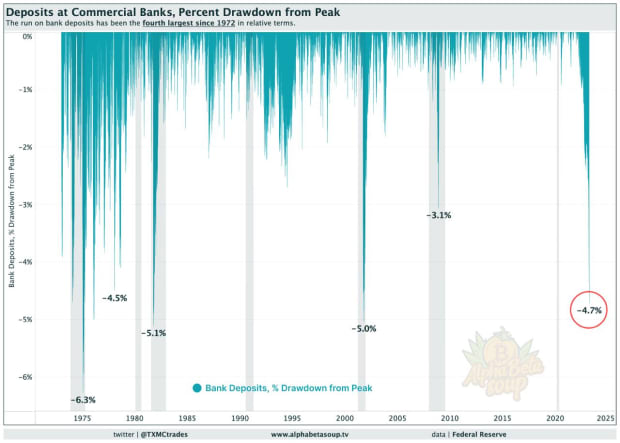

This accounting trick solely labored so long as depositors didn’t withdraw their funds. Now that there are report withdrawals taking place, as demonstrated within the chart under, it’s exposing the insolvency and inflicting banks to fail.

Why Are Folks Withdrawing Their Cash At Historic Charges?

There are two principal the reason why depositors are withdrawing their cash.

Firstly, as depositors lose confidence of their banks, it causes them to maneuver their cash to a financial institution that they belief extra. Secondly, excessive rates of interest are inflicting depositors to wire their cash out of their accounts to hunt larger yield in cash market funds, bonds, assured funding contracts (GICs) and certificates of deposit (CDs) and different funding automobiles.

Perhaps you haven’t thought of how unfair that is, however many individuals are realizing that the banks and central banks are profiting from them.

Let’s say you’ve been depositing and saving cash at an enormous financial institution, and the large financial institution offers you a financial savings price of roughly 0%. The large financial institution took your cash and acquired authorities debt throughout QE and acquired central financial institution reserves which it parks on the central financial institution and now will get paid about 5%!

Persons are waking as much as how unfair that is, and they’re wiring their financial savings out of their banks and placing it into investments and different shops of worth, like gold, actual property and bitcoin.

In an age of digital cash, financial institution runs within the 2020s don’t seem like they did within the Nineteen Twenties. As an alternative of lineups across the nook, now we’ve digital financial institution runs.

In 2022, a report $600 billion in deposits had been withdrawn from U.S. banks:

TXMC, a financial historian and market analyst, has advised {that a} extra truthful method to visualize the quantity of withdrawals is by trying on the p.c drawdown in financial institution deposits, which adjusts for the rise within the cash provide over time:

Both approach you select to have a look at the information, there’s a historically-significant quantity of withdrawals taking place from financial institution accounts.

Blaming COVID Is Inaccurate: Authorities Bonds Are Dropping Worth

The banks are backing solely a fraction of deposits by holding a few of their reserves in HQLAs like U.S. treasuries, that are speculated to be simply transformed to {dollars}. (Colloquially, this is called “cash good.”)

U.S. treasuries are considered the most secure collateral on the planet. The U.S. bond market has traditionally been deeply liquid and U.S. bonds are thought-about to be the “world reserve asset” alongside the U.S. greenback because the “world reserve foreign money.”

Nonetheless, the cracks began to look within the basis of the monetary system in 2019, earlier than the pandemic was used as an impetus to restart QE.

In 2019, the Federal Reserve tried to slowly elevate rates of interest and stopped doing QE.

Since we function on a debt-based cash system the place our economies are hooked on stimulus, when the central bankers “took away the punch bowl” by stopping QE, and began to slowly elevate charges, the interbank lending markets froze up. In a single day, bank-to-bank borrow charges massively shot as much as greater than 10%!

This liquidity freeze up is just like what began the 2008 monetary disaster, so the Federal Reserve instantly intervened within the interbank lending markets and began doing a stealth type of financial institution bailouts the yr earlier than anybody had even heard of COVID-19.

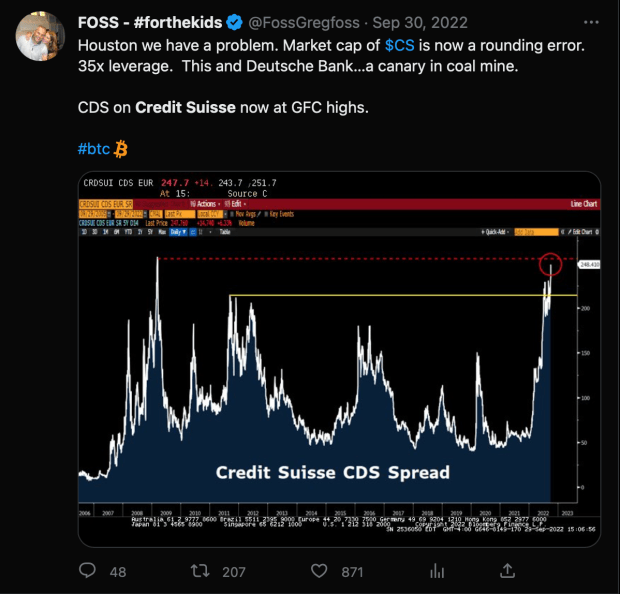

Many had been speculating at the moment, in 2019, that Credit score Suisse or Deutsche Financial institution had been functionally bancrupt, and that they — and plenty of different banks — would have failed a lot sooner had the central banks not intervened in 2019 and 2020 with huge bailouts within the interbank lending markets, the company bond markets and the U.S. treasuries market.

Since cracks have began to point out within the U.S. treasuries and mortgage-backed securities (MBS) markets in 2019, 2020 and 2021 with no-bid auctions, price volatility and rising illiquidity, the central banks are doing no matter they’ll to stop banks from having so as to add promote stress to the U.S. treasuries markets.

With report outflows from depositors, banks like Silicon Valley Financial institution and Credit score Suisse had been pressured to begin promoting their bonds, realizing the losses on their underwater bond portfolios and going bancrupt.

These points within the banking system and bond markets weren’t brought on by COVID-19, and the pattern of financial institution failures is clearly not over as one other massive U.S. financial institution, First Republic Financial institution, has been taken over by the FDIC and bought to JPMorgan.

Added Pressures From Europe And Russian Sanctions

Virtually exactly one yr earlier than Silvergate Financial institution failed within the U.S., kicking off a wave of financial institution failures, I wrote about how the Russia sanctions had been a nuclear bomb that went off within the banking system and anticipated to see a wave of financial institution failures come within the wake of it.

Very similar to how two nuclear bombs ended World Struggle II, capital-crushing central financial institution coverage price hikes and Russian sanctions had been like two nuclear bombs dropped on the economic system and the banking system. The shock wave took one yr to make its approach all over the world, and now we’re coping with the fallout.

European banks like Deutsche Financial institution and Credit score Suisse had been very intertwined with Russia, and tried to withstand slicing ties with Russian enterprise strains as this is able to inevitably result in their failures, which might unfold as contagion to the remainder of the worldwide banking system.

Whenever you need to get an thought of the well being of a financial institution, you possibly can take a look at a number of issues, issues similar to:

- CET1

- LCR

- Share worth

- Credit score default swaps (CDS)

We already lined CET1 and LCR earlier, and a financial institution’s share worth dropping is a fairly apparent signal that market members have discovered one thing regarding, so let’s talk about credit score default swaps.

CDS are a type of insurance coverage towards debt defaults and insolvency for big institutional merchants and buyers to hedge the chance of proudly owning the debt of an entity. Folks watch the CDS market to get one other sign of what subtle buyers suppose the probability of an entity defaulting is.

In July 2021 and once more in September 2022, Canadian bond dealer and 35-year threat supervisor Greg Foss publicly warned of the incredibly-alarming rise within the worth of CDS insurance coverage towards Credit score Suisse and Deutsche Financial institution:

Credit score Suisse had publicity to some smaller funds that went bancrupt in 2021, which restarted its troubles and speculations round its insolvency.

After the Russian sanctions and price hikes added much more stress and concern, Credit score Suisse skilled an $88 billion financial institution run by means of the summer season and fall of 2022.

One other $69 billion was withdrawn in Q1 2023 and fears round its insolvency grew, which the CDS market confirmed.

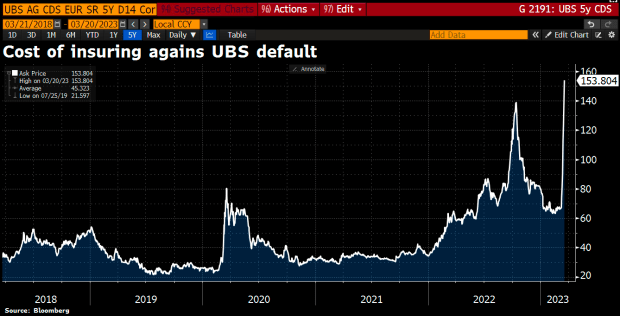

Because the financial institution began liquidating its bonds at a loss, now not in a position to cover its insolvency with held-to-maturity accounting, a pressured takeover by UBS financial institution with a backstop from the Swiss authorities occurred.

Switzerland has a GDP of solely $800 billion, so many are beginning to fear about

the credibility of the Swiss nationwide financial institution backstop, in addition to the solvency of UBS. You may see this within the rising price of insurance coverage towards a UBS default within the CDS market.

The chance didn’t go away when Credit score Suisse failed, it transferred to UBS:

How Unhealthy Is This In contrast To Earlier Financial institution Failures?

Three of the biggest financial institution failures in U.S. historical past have simply occurred, Silicon Valley Financial institution at $209 billion, Signature Financial institution at $118 billion and First Republic Financial institution at $229 billion.

(For reference, the biggest financial institution failure in U.S. historical past was Washington Mutual at $307 billion in 2008.)

Lots of of U.S. banks would technically be bancrupt if it weren’t for HTM accounting, in an identical place because the banks which have failed already. Time will inform if banks like Silicon Valley Financial institution and Silvergate had been the riskiest banks or simply the primary banks to fail.

The failure of those massive banks led to emergency motion by the Federal Reserve, beginning up a brand new spherical of bailouts and lending applications designed to stop the banks from having to understand the losses on their U.S. treasuries.

As an alternative of getting to promote their HQLA authorities bond portfolios and realizing losses to satisfy withdrawals, they’ll now borrow cash from the Federal Reserve towards their bond portfolios on the held-to-maturity worth fairly than the precise market worth.

Primarily, central planners intervened with the free market pricing mechanism, rescuing banks as soon as once more by permitting them to mark up the worth of their bond portfolios to their held-to-maturity values fairly than simply borrow freshly printed Fed cash — permitting them to borrow much more cash than what the bonds are price.

Usually, banks keep away from borrowing from the Fed by way of the low cost window as there’s a stigma hooked up to the establishments who achieve this. Bear in mind, the colloquial time period is that the Fed is the “lender of final resort.”

Because it’s public who’s borrowing from the Fed as a final resort, that’s interpreted as an indication of weak point by the market. However when there’s systemic threat within the system, the stigma of borrowing from the Fed appears to be eliminated.

Unusually, the Federal Reserve is definitely charging banks a fairly excessive rate of interest.

On this state of affairs, the Federal Reserve has gone from the lender of final resort to the mortgage shark of final resort for small- and medium-sized banks, paying about 5% for Financial institution Time period Funding Program (BTFP) funding or borrowing on the Fed’s low cost window.

They name this program BTFP, and I take a look at it like a dwelling will for the U.S. banking system.

What The BTFP Does To Sluggish The Banking Disaster

The Fed’s BTFP does two issues.

Firstly, it hopes to cease the banking disaster by giving banks extra time to course of withdrawals, stopping panic from spreading as prospects return to a state of complacency with their deposits.

It’s shopping for time. The longer this attracts out, the extra they’ll management the narrative.

Secondly, if that fails and this actually is the decision of the 2008 disaster the place we see sustained financial institution runs and systemic financial institution insolvencies, the BTFP helps cut back the stress on the FDIC if it has to resolve tons of of small and medium financial institution failures.

As we’ve discovered thus far, there’s not sufficient demand within the free market to purchase the bonds that the federal government is attempting to promote, so the central financial institution has to purchase the bonds to fund authorities deficit spending and QE.

There may be upwards of $2 trillion in bonds held by tons of of small- and medium-sized banks.

If these banks should promote these bonds into the market, that may freeze up the bond market, which could trigger a lack of confidence within the cash itself, which is far worse than a lack of confidence in banks.

The Fed’s BTFP permits them to create as much as $2 trillion and lend it to those banks, taking their underwater bonds off the market and placing some 500 small- and medium-sized U.S. banks into debt to the Fed.

If these banks fail, the Federal Reserve can take in the bond collateral onto its stability sheet with out it trying like one other spherical of QE and bailouts because the banks have turn out to be debtors to the Fed.

These money-printing, bank-lending schemes are all about shopping for time and stopping concern from spreading in each the banking system and the bond market themselves.

Is This A Widespread Banking Disaster?

If sufficient prospects attempt to withdraw their cash from banks, the banks will go bancrupt… as a result of not solely are the {dollars} printed from nothing, however the banks don’t even have the “{dollars}” anymore.

In actual fact, the cash in your checking account is just not even “your cash.” It’s truly a legal responsibility on the financial institution’s stability sheet. This is the reason financial institution bail-in provisions had been written into legislation post-GFC.

In the event that they cannot forestall the concern from spreading and we see a systemic failure, banks can legally do bail-ins and haircuts above the CDIC/FDIC limits, like we noticed in Greece and Cyprus a decade in the past.

The FDIC and the Fed knew the banks had been in bother final yr. They began holding conferences and attempting to give you rule modifications to determine the best way to resolve massive financial institution failures.

They know FDIC insurance coverage is a fairy story designed to maintain depositors placated and that if massive banks begin to fail, the FDIC fund is laughably undercapitalized to resolve that scenario.

They mentioned doing haircuts and financial institution bail-ins, in addition to disclosing data on the true dangers within the banking system to the general public prematurely of a systemic occasion.

Some current feedback from FDIC regulators on financial institution bail-ins from November 2022:

“It’s necessary that folks perceive they are often bailed-in. You don’t need an enormous run on the establishments, however there are going to be (runs) and it could possibly be an early warning sign to the FDIC and the first regulators.

“…and if there’s important long-term debt, you possibly can ponder a bail-in-type exit for these establishments the place you’re turning the establishment over to its collectors.”

There doesn’t appear to be the political will to permit bail-ins to occur but.

As we noticed simply a few months after this FDIC assembly, when banks truly began to fail, the Silicon Valley billionaires had been bailed out immediately and all deposits had been assured.

The $250,000 FDIC restrict was basically thrown out the window instantly.

Whereas the authorized framework is in place, bail-ins appear to be a final resort instrument on the backside of the toolbox. You may consider bail-ins like lockdowns. They may solely go along with that choice when they’re about to fully lose management. In February 2020, the thought of colleges and public buildings being shut down and everybody being pressured to remain at residence was considered hyperbolic and ridiculous.

FDIC/CDIC Unable To Deal with The Failures Of Massive Banks

In actual fact, if you take a look at the CET1 ratios of Canadian banks, it doesn’t look nice.

Silicon Valley Financial institution failed with a CET1 ratio of 14%, and Credit score Suisse failed with a CET1 ratio of 15%, which is best than the Royal Financial institution of Canada (RBC), Canadian Imperial Financial institution of Commerce (CBIC) or Scotiabank, that are all underneath 13%:

The chance was not flushed out of the system after the 2008 monetary disaster.

They socialized the losses and privatized the beneficial properties with bailouts and stimulus, growing wealth inequality, damaging the buying energy of your financial savings and kicking the can down the street so far as they may.

The can is at our ft once more. We’re at a fork within the street.

There’s not sufficient capital buffer within the banking system to soak up the large losses in these bond markets.

Preston Pysh, host of “The Buyers Podcast,” just lately tweeted:

“The full capital buffer within the US banking system is $2.2 trillion, whereas unrealized losses are between $1.7 and $2 trillion. If banks needed to liquidate their bond and mortgage portfolios, they’d lose 77-91% of their capital cushion, highlighting the fragility of most banks. 186 US banks are in misery.”

The concept CDIC/FDIC insurance coverage can cowl the losses from a systemic failure is a fantasy.

The FDIC couldn’t deal with even the primary financial institution failure in 2023 and needed to tag within the U.S. Treasury and the Federal Reserve to backstop depositors, as 97% of the deposits of that financial institution had been these millionaires and billionaires, evidenced by the truth that they had been above the $250,000 deposit insurance coverage restrict.

They determined to rescue all depositors as an alternative of making use of haircuts/bail-ins as a result of, understandably, they felt like it could result in systemwide panic and full-on

financial institution run, cascading to an unstoppable banking disaster like we noticed within the Nineteen Twenties, fairly than the one in 2008.

There was additionally an actual, reliable difficulty of many Silicon Valley corporations being unable to satisfy payrolls on the next Monday, and what that might do to the economic system, which is overly depending on tech corporations.

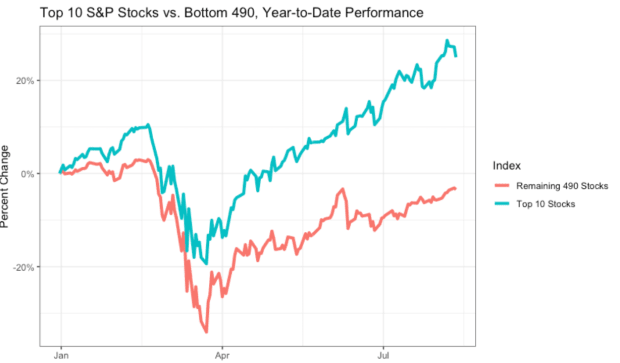

Tech corporations drive inventory market efficiency: In the event you take a look at the inventory efficiency of the highest 5 or 10 tech corporations, after which take a look at the opposite 490 corporations within the S&P 500, the financial outlook would look quite a bit worse:

Think about what would occur to the U.S. inventory market, which has been artificially inflated to report excessive costs by way of cash printing and low rates of interest, if Fb, Google, Microsoft and the entire non-profitable-but-public tech corporations misplaced tens of billions of {dollars} to bail-ins and couldn’t meet payroll.

The alternatives dealing with the FDIC, U.S. Treasury and Federal Reserve will not be straightforward ones. There are many years of coverage errors and bipartisan political blundering that introduced us right here.

So, is the $250,000 FDIC restrict only a fantasy if all deposits of the Silicon Valley elite had been backstopped? Did the federal government simply inform us that it’s going to socialize all cash within the banking

system with this motion, or is it simply going to choose winners and losers as extra banks begin to fail, and finally the bail-ins begin?

Foss has identified that, even with the entire bailouts, emergency lending applications and confidence video games that the Fed, U.S. Treasury and FDIC are enjoying, quickly the rate of interest threat would possibly spillover to credit score threat, which shall be even worse for banks.

The FDIC was fashioned within the Nineteen Thirties when america was nonetheless on a somewhat-sound financial commonplace; it was a approach to supply confidence to depositors within the U.S. banking system who had misplaced belief within the banks.

At the moment, the FDIC fund solely has round $100 billion, which is decrease than the mandated quantity. Buffet has extra money than the FDIC fund does.

Because the financial system transitioned from sound cash to credit score cash, and the provision of cash expanded quickly, the thought of FDIC insurance coverage is extra of an phantasm — one other confidence sport.

We’re speculated to imagine that this FDIC insurance coverage is financed by charges that banks pay on deposits, nonetheless, as we’ve seen with the current financial institution failures and in earlier durations of economic disaster — such because the financial savings and mortgage disaster within the ’80s and ’90s and throughout the GFC in 2008 and 2009 — the FDIC is just too huge to fail and it’ll additionally get bailed out.

They may do no matter they should as a way to forestall individuals from peeking behind the cash curtain to see how issues actually function.

So, what does all of this imply?

One factor is for sure, all of this central planning and interference within the free market to stop the chance from flushing out of the system has a price:

Wealth inequality goes to maintain rising and your cash goes to proceed to lose buying energy over time, most likely at an accelerated price.

I imagine there are actually solely three ways in which this may be resolved.

One: No Can Kick, Main To Deflation And Falling Costs

Why would we see this? Nicely, the G8 central bankers are all attempting to battle inflation concurrently they’re attempting to stop a banking sector meltdown, which requires them to maintain elevating charges and never doing any extra blatant QE (though, in Canada, we raised first and have since put a pause on elevating charges.)

One more reason why this state of affairs is believable is the looming debt ceiling. There’s a statutory cap on the quantity of debt the U.S. authorities can have, and it’ll have to be legally raised once more earlier than one other huge spherical of stimulus can occur.

In 1939, U.S. Congress handed the preliminary “Public Debt Act” which established limits on combination U.S. debt ranges.

The debt ceiling has been raised 98 occasions since, though typically this turns into a partisan battle if an opposing occasion controls the presidency, home or senate.

Within the lengthy arc of historical past, it actually does not matter who’s in energy; they finally elevate the debt ceiling and print.

Nonetheless, this debt-ceiling impasse could cause issues within the brief time period, and we’re doubtlessly dealing with that state of affairs now the place the Republican-controlled Senate doesn’t need to enable the Democratic president to difficulty extra debt coming as much as an election yr.

That is deflationary as a result of it successfully shrinks the cash provide and would result in a seamless decline in bonds and shares.

Within the “no can kick” state of affairs, we might see extra banks fail and we may doubtlessly even see the intense situations required to power bail-ins the place depositors begin to take haircuts.

Actual property would crash on this deflationary spiral, erasing the “phantom wealth” that most individuals really feel once they borrow towards their retirement accounts and actual property portfolios which have grown quickly in worth throughout the bubble.

This might result in governments being unable to run huge deficits, as there could be no net-new patrons for bonds and confidence could be misplaced in authorities treasuries because the most secure place to guard wealth.

Two: Can Kicked Too Onerous, Main To Hyperinflation

This state of affairs is the least prone to occur within the U.S. or Canada. It’s extraordinarily unlikely but price discussing as it could require huge coverage errors.

On this state of affairs, we see some exogenous occasion similar to a once-in-a-generation pandemic, or a coronal mass ejection (CME) just like the Carrington Occasion, maybe a nuclear warfare or an unstoppable rogue AI web virus, which causes an acceleration of current dangers within the system.

Some individuals name these hard-to-predict monetary shocks “black swan” occasions.

If we get a major black swan occasion that accelerates the present banking disaster, we may see a sudden collapse of tons of of banks as international inventory markets quickly crash and bond markets lock up, equally to what we noticed in 2008 or in March 2020.

An actual property market correction may additionally speed up to a crash, inflicting public outcry for policymakers and central bankers to as soon as once more decrease rates of interest and rescue the economic system.

Emergency measures could be taken, just like what we noticed within the aftermath of COVID-19, nonetheless, this time we might possible see Nineteen Thirties-style worth fixing, capital controls and rather more huge bailouts by the federal government and central banks.

Provided that they print obscene quantities of cash in response to the disaster can we begin to enter hyperinflation territory.

Hyperinflation is outlined as fast financial inflation inflicting costs to extend at 50% month over month. Oftentimes when individuals use the time period hyperinflation, they don’t truly understand what they’re saying, they usually can sound hyperbolic to somebody who understands the dictionary definition of the phrase.

Policymakers must make all of the improper selections and never have discovered something from historical past to trigger a hyperinflationary collapse.

It’s a impossible state of affairs.

Three: Can Kicked, Standing Quo With Inflation

That is the almost definitely state of affairs. There’s no political will to see deposits begin taking haircuts, and no person appears to need to pull the lever to be chargeable for a recession.

With a status-quo can kick after the debt ceiling is raised, we get continued waves of upper inflation with rates of interest held decrease.

The bond markets proceed getting propped up by the central banks as QE restarts and the Fed’s stability sheet expands by upwards of $10 trillion to $20 trillion.

That is the place we see Ponzi finance beginning to turn out to be extra apparent to most individuals because the share of the U.S.’s debt owned by the Fed crosses 50%.

I’m unsure whether or not it is going to be in a position to battle the free market forces of upper rates of interest, however it can attempt to artificially drop charges as near zero as it might get it as a way to finance the large and rising debt of the private and non-private sectors as inflation rises and we proceed in the next inflation setting.

This creates one other disaster in about 10 years.

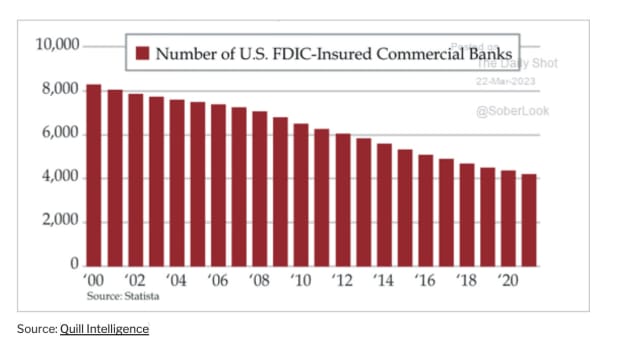

Since banks are bancrupt in any of those situations, we should still see tons of of financial institution failures which is able to result in additional centralization of the banking system.

We’ll possible see the continued pattern of banking Canadianization within the U.S., the place 500 to 1,000 small and medium banks fail and get absorbed by bigger banks.

The FDIC can’t resolve this many banks, which is why the Fed is performing because the mortgage shark of final resort.

The Fed absorbs as much as $2 trillion of treasuries from the bancrupt banks as they default on their loans from the Fed.

How Do You Defend Your self?

Diversification out of greenback financial savings and into extra scarce belongings is sensible. International index funds, gold, farm land, bitcoin, and so forth. are all enticing choices to guard and develop your buying energy.

The response to the disaster is probably going going to be extra of the identical: printing cash and bailouts.

The buying energy of the greenback will proceed to say no towards scarce belongings like gold and bitcoin.

Most individuals studying this is not going to manage to pay for to speculate into one thing like farmland, and whereas dollar-cost averaging into index funds has traditionally been an important wager, it has the identical counterparty dangers to a banking system collapse and capital controls as maintaining cash within the financial institution does.

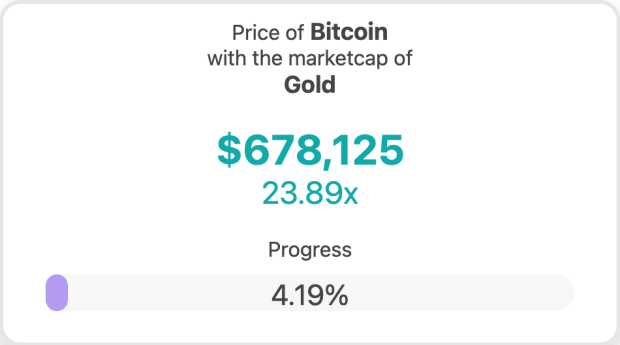

In comparison with gold, bitcoin is the quickest horse within the race and it’s prone to improve in buying energy sooner than gold till it will get to gold parity, possible inside 10 years.

For reference, the value of 1 bitcoin must improve by about 24 occasions to $678,125 per bitcoin to ensure that it to have the identical market cap as gold.

As Bitcoin beneficial properties relevance as a post-trust, world-reserve asset and digital foreign money for the web, it may rise in worth considerably.

On Bitcoin’s Volatility

In the event you’re a rich investor who’s nervous about bitcoin’s historic volatility, even having a conservative allocation, like 5% of your web price, to bitcoin as an insurance coverage plan remains to be a smart technique.

In case your bitcoin drops considerably in worth, or for those who lose conviction and promote it in a drawdown, it received’t materially have an effect on your life. Nonetheless, if bitcoin does what many people anticipate it can do over the subsequent 5 to eight years, a 5% allocation to bitcoin may present outsized returns.

In the event you’re the common Canadian who doesn’t have a major web price and lives paycheck to paycheck, saving a bigger portion of each verify in bitcoin with a five-to-10-year timeframe may change your life considerably. It did mine.

As a bootstrapped web entrepreneur with no investing expertise, I discovered about cash, the banking system and diversified funding methods over the past 15 years managing my very own wealth.

I began with a small allocation to bitcoin in 2011, and although I’ve made many errors alongside the way in which throughout my school-of-hard-knocks schooling, the small bitcoin allocation has turn out to be the vast majority of my web price.

I nonetheless maintain different belongings like gold, index funds, actual property and money. I’ve held bitcoin by means of many unstable drops of fifty% to 80% and I’m nonetheless shopping for bitcoin right this moment with free cashflow.

At all times anticipate the value of bitcoin to drop by at the least 50% from the place you obtain it — volatility is a part of bitcoin’s story because it bootstraps its method to turn out to be a worldwide retailer of worth. It’s crucial that you concentrate on bitcoin as a long-term financial savings play, not a commerce.

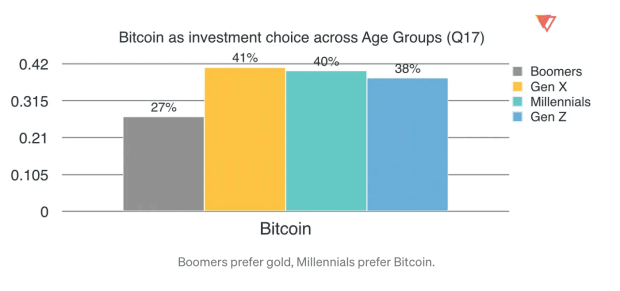

There’s a $60 trillion wealth switch coming from the silent technology and boomers to the youthful generations. Gen X, millennials and Gen Z all choose bitcoin over shares, gold and money:

Bitcoin has a credibly-scarce, disinflationary provide cap of 21 million, enforced by math, auditable by anybody and resistant to alter by central planners, insiders or governments.

With an ever-increasing demand for BTC by youthful, digital-native generations of their high-earning years, who will quickly see a large wealth switch, the expansion outlook for bitcoin is prone to solely preserve rising.

Additionally, it’s price noting that bitcoin patrons usually have very excessive conviction. You may see within the knowledge that almost all of bitcoin holders perceive what they’re shopping for, and they’re keen to carry and even purchase extra by means of massive drawdowns.

When the value of bitcoin peaked in 2021 and went by means of a bear market in 2022, dropping greater than 70% from the excessive — the long-term holders truly elevated their positions:

It is because bitcoin savers use a technique often called dollar-cost averaging (DCAing). Bitcoin educators and influencers usually advocate a DCA technique to keep away from the follies of attempting to time the market and turn out to be a dealer.

Saving trumps buying and selling in 90% of instances.

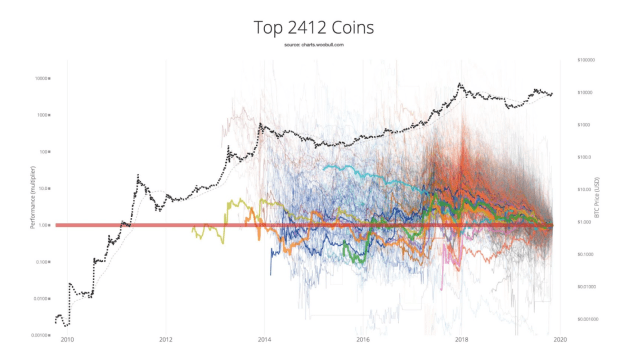

‘Ought to I Purchase Bitcoin Or One Of The Different Cryptos?’

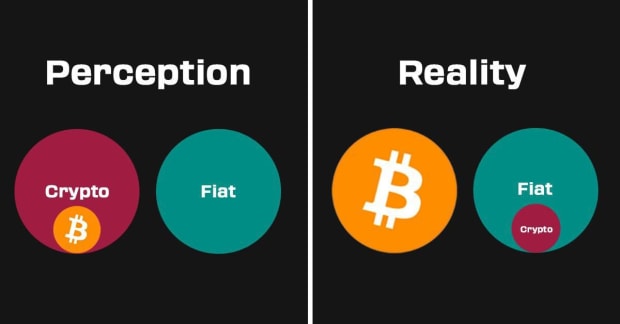

A standard false impression about Bitcoin is that it’s the similar as “crypto.”

If I had been to emphasize something that you could possibly take away from this, it’s that Bitcoin is just not the identical as crypto.

Most individuals would do nicely if they only ignored crypto and discovered as a lot as they may about Bitcoin.

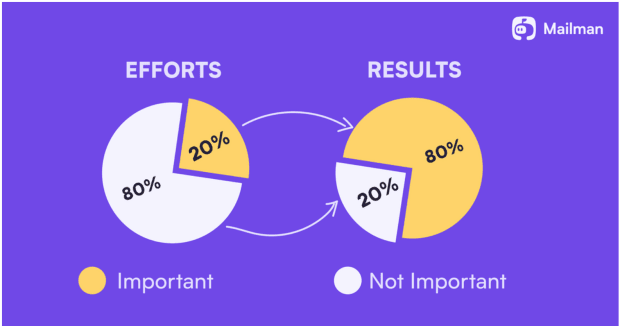

The Pareto precept, also called “the 80/20 rule,” applies to Bitcoin. My recommendation to most of my family and friends member who ask me about different cash to purchase is that this:

You’ll obtain 80% of the outcomes of energetic crypto merchants with 20% of the trouble for those who merely save in and find out about BTC, ignore crypto and maintain your BTC for 10 years.

At this level, a lot of the over 1 million crypto tokens are literally some variation of a Ponzi scheme, and plenty of of them have been exploding over the past two years as a result of they haven’t any worth apart from better idiot principle.

Not all of them are Ponzis. A few of them are simply pump-and-dump meme investments, dangerous bets and even would-be “subsequent bitcoin” opponents. A small share of them might need some reliable worth into the longer term.

Maybe you’ve seen the top-25 or -50 crypto tokens and thought you can purchase ETH, BNB or XRP to diversify into “crypto” as a complete fairly than simply merely save in bitcoin.

On this case, I strongly advise you to recollect the Pareto precept and be taught extra about Bitcoin. It’s best to do the work to know why Bitcoin is effective earlier than you attempt to perceive any of the cryptocurrency tickers.

Within the important majority of instances, whether or not it’s Ethereum, Solana, Dogecoin or an NFT out of your favourite influencer, shopping for a crypto token is extra like VC investing, shopping for penny shares, foreign currency trading, playing or different types of hypothesis.

Bitcoin is saving. Crypto is theory.

Speculators can generate income, however except you need to be glued to charts, consuming crypto content material for 80 hours per week whereas additionally studying the best way to be knowledgeable portfolio and threat supervisor, you most likely received’t come out forward.

In the event you wouldn’t end up on r/wallstreetbets searching for the subsequent YOLO wager on a meme inventory, then don’t trouble studying about Ethereum, DeFi, Web3, NFTs or “degen” crypto buying and selling schemes.

In the event you would end up on r/wallstreetbets searching for the subsequent get-rich-quick wager… do your self a favor and don’t drink the crypto kool help.

There isn’t a such factor as “the subsequent Bitcoin.” Bitcoin is the subsequent Bitcoin.

The Actuality Of Making an attempt To Outperform Bitcoin With Altcoins

The vast majority of crypto merchants won’t ever get again to their BTC excessive watermark. The one method to beat Bitcoin long run is:

- Both give your cash to, or be, an distinctive skilled dealer with clearly outlined buying and selling guidelines and execute your buying and selling guidelines emotionlessly. The vast majority of merchants lose.

- Get fortunate and get out. If somebody was fortunate sufficient to purchase a meme coin that rose 100 occasions in its worth in a bubble, they possible will return into the on line casino and provides the vast majority of it again within the bear market.

- Be an insider. Most profitable individuals in crypto have gone out on the ethical threat curve, and exploited their reputations and insider entry. They receives a commission to advertise cash, launch their very own cash or get into presales. All of those methods enable insiders to commerce their reputations for earnings, getting cash without cost (or extraordinarily low-cost) as a way to dump them on retail at elevated costs.

Even most insiders and enterprise capitalists received’t get this proper as, oftentimes, in addition they drink the kool help, keep within the on line casino for too lengthy and, over an extended sufficient timeframe, they turn out to be bagholders as nicely.

In fact you will note individuals cherry decide outlier cash or timeframes and say issues like, “In the event you purchased and held X coin in Y timeframe, you’d have out carried out bitcoin.”

Nonetheless, these individuals at all times pass over the very related fact that crypto buyers don’t simply purchase and maintain — they deploy into (and incur important losses in) the principally fraudulent markets of the Ethereum and crypto Web3/DeFi ecosystem.

To recap, there are two faculties of recommendation givers you’ll come throughout in “crypto”:

- Bitcoiners. They advocate a easy purchase and maintain technique to save lots of in bitcoin over very long time frames, like I’m advocating for proper now.

- Crypto buyers. They advocate for going out on the chance curve, spreading your bets and allocating to the meat grinder of rug pulls, yield schemes, exploits, fuel wars, entrance operating, sandwich assaults and trade hacks.

A buy-and-hold-bitcoin financial savings technique is the very best for almost all of individuals as BTC outperforms the overwhelming majority of crypto cash over very long time frames.

Recommendation For Bitcoin Haters

In the event you’re a type of people who find themselves towards Bitcoin as a result of it’s digital, or for another motive, then it’s going to be a tough trip for you except you defend your self correctly with different types of scarce belongings.

Merely pulling money out of the financial institution is just not going to resolve the issue as a result of your money remains to be topic to the identical debasement as digital cash within the financial institution.

Having wholesome skepticism round Bitcoin is necessary — but it surely’s crucial that you just do the work. Don’t simply write it off as a result of you might have some misconceptions about it, or since you suppose you missed the boat.

Everybody ought to search to be taught from moral Bitcoin educators, not crypto merchants or blockchain digital snake oil salesmen.

Learn to use Bitcoin as a defend towards continued inflation of the cash provide which debases your financial savings and erodes your buying energy.

Listed below are my favourite assets to suggest you be taught extra about Bitcoin:

- Preston Pysh’s ”Bitcoin Fundamentals” podcast for bitcoin and monetary market content material

- Man Swann’s Bitcoin Audible web site the place he reads the very best Bitcoin articles

- Michael Saylor’s Hope.com for video interviews and articles

- Matthew Kratter’s Bitcoin College for bitcoin and investing instructional movies

- BTCSessions’ YouTube channel for Bitcoin walkthroughs and tutorials

It is a visitor submit by Brad Mills. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

from Bitcoin – My Blog https://ift.tt/awIrqzC

via IFTTT