Decentralization, n. The safety assumption {that a} nineteen yr outdated in Hangzhou and somebody who’s possibly within the UK, and possibly not, haven’t but determined to collude with one another.

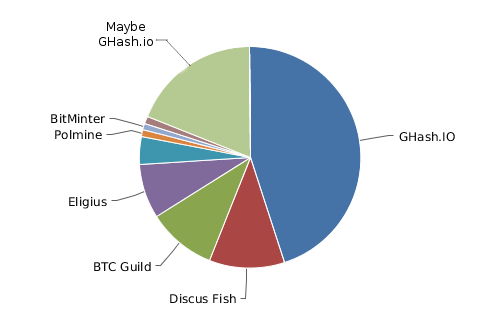

There was a considerable amount of ruckus previously week in regards to the problem of mining centralization within the Bitcoin community. We noticed a single mining pool, GHash.io, amass over 45% hashpower for a lot of hours, and at one level even develop to change into 51% of all the community. All the entrance web page of the Bitcoin reddit was ablaze in intense dialogue and a uncommon conflict of complacency and worry, miners shortly mobilized to take their hashpower off GHash, and surprisingly intelligent methods have been utilized in an try and convey again the stability between the totally different swimming pools, as much as and together with one miner with “between 50 TH/s and a pair of PH/s” mining at GHash however refusing to ahead legitimate blocks, basically sabotaging all mines on the pool to the extent of as much as 4%. Now, the state of affairs has considerably subsided, with GHash all the way down to 35% community hashpower and the runner up, Discus Fish, as much as 16%, and it’s seemingly that the state of affairs will stay that method for a minimum of a short time earlier than issues warmth up once more. Is the issue solved? After all not. Can the issue be solved? That would be the main topic of this submit.

Bitcoin Mining

To start with, allow us to perceive the issue. The aim of Bitcoin mining is to create a decentralized timestamping system, utilizing what is basically a majority vote mechanism to find out by which order sure transactions got here as a method of fixing the double-spending downside. The double-spending downside is easy to clarify: if I ship a transaction sending my 100 BTC to you, after which someday later I ship a transaction sending the identical 100 BTC to myself, each of these transactions clearly can not concurrently course of. Therefore, one of many two has to “win”, and the intuitively right transaction that ought to get that honor is the one which got here first. Nonetheless, there isn’t any method to take a look at a transaction and cryptographically decide when it was created. That is the place Bitcoin mining steps in.

Bitcoin mining works by having nodes known as “miners” combination latest transactions and produce packages known as “blocks”. For a block to be legitimate, all the transactions it accommodates have to be legitimate, it should “level to” (ie. comprise the hash of) a earlier block that’s legitimate, and it should fulfill “the proof of labor situation” (particularly, SHA2562(block_header) <= 2190, ie. the double-hash of the block header should begin with a lot of zeroes). As a result of SHA256 is a pseudorandom perform, the one strategy to make such blocks is to repeatedly try to provide them till one occurs to fulfill the situation. The two190 “goal” is a versatile parameter; it auto-adjusts in order that on common all the community must work for ten minutes earlier than one node will get fortunate and succeeds; as soon as that occurs, the newly produced block turns into the “newest” block, and everybody begins making an attempt to mine a block pointing to that block because the earlier block. This course of, repeating as soon as each ten minutes, constitutes the first operation of the Bitcoin community, creating an ever-lengthening chain of blocks (“blockchain”) containing, so as, all the transactions which have ever taken place.

If a node sees two or extra competing chains, it deems the one that’s longest, ie. the one which has probably the most proof-of-work behind it, to be legitimate. Over time, if two or extra chains are concurrently at play, one can see how the chain with extra computational energy backing it’s ultimately assured to win; therefore, the system could be described as “one CPU cycle, one vote”. However there may be one vulnerability: if one celebration, or one colluding group of events, has over 50% of all community energy, then that entity alone has majority management over the voting course of and might out-compute some other chain. This offers this entity some privileges:

- The entity can solely acknowledge blocks produced by itself as legitimate, stopping anybody else from mining as a result of its personal chain will all the time be the longest. Over time, this doubles the miner’s BTC-denominated income at everybody else’s expense. Notice {that a} weak model of this assault, “selfish-mining“, begins to change into efficient at round 25% community energy.

- The entity can refuse to incorporate sure transactions (ie. censorship)

- The entity can “return in time” and begin mining from N blocks in the past. When this fork inevitably overtakes the unique, this removes the impact of any transactions that occurred within the unique chain after the forking level. This can be utilized to earn a bootleg revenue by (1) sending BTC to an trade, (2) ready 6 blocks for the deposit to be confirmed, (3) buying and withdrawing LTC, (4) reversing the deposit transaction and as a substitute sending these cash again to the attacker.

That is the dreaded “51% assault”. Notably, nonetheless, even 99% hashpower doesn’t give the attacker the privilege of assigning themselves an arbitrary variety of new cash or stealing anybody else’s cash (besides by reversing transactions). One other essential level is that 51% of the community is just not wanted to launch such assaults; if all you need is to defraud a service provider who accepts transactions after ready N confirmations (normally,

N = 3or

N = 6), in case your mining pool has portion P of the community you possibly can succeed with likelihood

(P / (1-P))^N; at 35% hashpower and three confirmations, because of this GHash can presently steal altcoins from an altcoin trade with 15.6% success likelihood – as soon as in each six tries.

Swimming pools

Right here is we get to swimming pools. Bitcoin mining is a rewarding however, unfortuantely, very high-variance exercise. If, within the present 100 PH/s community, you’re operating an ASIC with 1 TH/s, then each block you’ve got an opportunity of 1 in 100000 of receiving the block reward of 25 BTC, however the different 99999 occasions out of 100000 you get precisely nothing. Provided that community hashpower is presently doubling each three months (for simplicity, say 12500 blocks), that provides you a likelihood of 15.9% that your ASIC will ever generate a reward, and a 84.1% likelihood that the ASIC’s complete lifetime earnings will likely be precisely nothing.

A mining pool acts as a type of inverse insurance coverage agent: the mining pool asks you to mine into into its personal handle as a substitute of yours, and in the event you generate a block whose proof of labor is nearly ok however not fairly, known as a “share”, then the pool offers you a smaller fee. For instance, if the mining problem for the primary chain requires the hash to be lower than 2190, then the requirement for a share may be 2190. Therefore, on this case, you’ll generate a share roughly each hundred blocks, receiving 0.024 BTC from the pool, and one time in a thousand out of these the mining pool will obtain a reward of 25 BTC. The distinction between the anticipated 0.00024 BTC and 0.00025 BTC per block is the mining pool’s revenue.

Nonetheless, mining swimming pools additionally serve one other goal. Proper now, most mining ASICs are highly effective at hashing, however surprisingly weak at all the things else; the one factor they usually have for common computation is a small Raspberry Pi, far too weak to obtain and validate all the blockchain. Miners may repair this, at the price of one thing like an additional 0 is lower than $100. As an alternative, they ask mining swimming pools to generate mining knowledge for them. The “mining knowledge” in query refers back to the block header, just a few hundred bytes of information containing the hash of the earlier block, the basis of a Merkle tree containing transactions, the timestamp and another ancillary knowledge. Miners take this knowledge, and proceed incrementing a worth known as a “nonce” till the block header satisfies the proof-of-work situation. Ordinarily, miners would take this knowledge from the block that they independently decide to be the newest block; right here, nonetheless, the precise collection of what the newest block is is being relegated to the swimming pools.

Thus, what do we now have? Nicely, proper now, basically this:

The mining ecosystem has solidified into a comparatively small variety of swimming pools, and each has a considerable portion of the community – and, in fact, final week a type of swimming pools, GHash, reached 51%. Given that each time any mining pool, whether or not Deepbit in 2011 or GHash in 2013, reached 51% there was a sudden huge discount within the variety of customers, it’s totally potential that GHash truly bought wherever as much as 60% community hashpower, and is just hiding a few of it. There’s loads of proof in the true world of enormous firms creating supposedly mutually competing manufacturers to present the looks of alternative and market dynamism, so such a speculation ought to by no means be discounted. Even assuming that GHash is in reality being trustworthy in regards to the stage of hashpower that it has, what this chart actually says is that the one cause why there will not be 51% assaults occurring in opposition to Bitcoin proper now could be that Discus Fish, a mining pool run by a nineteen-year-old in Hangzhou, China, and GHash, a mining pool run supposedly within the UK however might be wherever, haven’t but determined to collude with one another and take over the blockchain. Alternatively, if one is inclined to belief this explicit nineteen-year-old in Hangzhou (in any case, he appeared fairly good once I met him), Eligius or BTCGuild can collude with GHash as a substitute.

So what if, for the sake of instance, GHash will get over 51% once more and begins launching 51% assaults (or, maybe, even begins launching assaults in opposition to altcoin exchanges at 40%)? What occurs then?

To start with, allow us to get one dangerous argument out of the best way. Some argue that it doesn’t matter if GHash will get over 51%, as a result of there isn’t any incentive for them to carry out assaults in opposition to the community since even one such assault would destroy the worth of their very own forex models and mining {hardware}. Sadly, this argument is just absurd. To see why, contemplate a hypothetical forex the place the mining algorithm is just a signature verifier for my very own public key. Solely I can signal blocks, and I’ve each incentive to take care of belief within the system. Why would the Bitcoin group not undertake my clearly superior, non-electricity-wasteful, proof of labor? There are a lot of solutions: I may be irrational, I would get coerced by a authorities, I would begin slowly inculcating a tradition the place transaction reversals for sure “good functions” (eg. blocking baby pornography funds) are acceptable after which slowly develop that to cowl all of my ethical prejudices, or I would also have a huge quick in opposition to Bitcoin at 10x leverage. These center two arguments will not be loopy hypotheticals; they’re real-world documented actions of the implemenation of me-coin that already exists: PayPal. That is why decentralization issues; we don’t burn hundreds of thousands of {dollars} of electrical energy per yr simply to maneuver to a forex whose continued stability hinges on merely a barely totally different type of political recreation.

Moreover, it is very important word that even GHash itself has a historical past of involvement in utilizing transaction reversal assaults in opposition to playing websites; particularly, one could recall the episode involving BetCoin Cube. After all, GHash denies that it took any deliberate motion, and might be right; somewhat, the assaults appear to be the fault of a rogue worker. Nonetheless, this isn’t an argument in favor of GHash; a lot the alternative, it’s a piece of real-world empirical proof exhibiting a standard argument in favor of decentralization: energy corrupts, and equally importantly energy attracts those that are already corrupt. Theoretically, GHash has elevated safety since then; in observe, it doesn’t matter what they do that central level of vulnerability for the Bitcoin community nonetheless exists.

Nonetheless, there may be one other, higher, argument for why mining swimming pools will not be a problem: particularly, exactly the truth that they aren’t particular person miners, however somewhat swimming pools from which miners can enter and depart at any time. Due to this, one can fairly say that Ars Technica’s declare that Bitcoin’s safety has been “shattered by an nameless miner with 51% community energy” is totally inaccurate; there isn’t any one miner that controls something near 51%. There’s certainly a single entity, known as CEX.io, that controls 25% of GHash, which is horrifying in itself however nonetheless removed from the state of affairs that the headline is insinuating is the case. If people miners don’t wish to take part in subverting the Bitcoin protocol and inevitably knocking the worth of their cash down by one thing like 70%, they’ll merely depart the pool, and such a factor has now occurred thrice in Bitcoin’s historical past. Nonetheless, the query is, because the Bitcoin financial system continues to professionalize, will this proceed to be the case? Or, given considerably extra “grasping” people, will the miners carry on mining on the solely pool that lets them proceed incomes income, individually saving their very own income at the price of taking all the Bitcoin mining ecosystem collectively down a cliff?

Options

Even now, there may be truly one technique that miners can, and have, taken to subvert GHash.io: mining on the pool however intentionally withholding any blocks they discover which are truly legitimate. Such a technique is undetectable, however with a 1 PH/s miner mining on this method it basically reduces the income of all GHash miners by about 2.5%. This type of pool sabotage utterly negates the good thing about utilizing the zero-fee GHash over different swimming pools. This capability to punish dangerous actors is attention-grabbing, although its implications are unclear; what if GHash begins hiring miners to do the identical in opposition to each different pool? Thus, somewhat than counting on vigilante sabotage techniques with an unexamined financial endgame, we must always ideally attempt to search for different options.

To start with, there may be the ever-present P2P mining pool, P2Pool. P2Pool has been round for years, and works by having its personal inside blockchain with a 10-second block time, permitting miners to submit shares as blocks within the chain and requiring miners to aim to provide blocks sending to all the previous few dozen share producers on the identical time. If P2Pool had 90% community hashpower, the end result wouldn’t be centralization and benevolent dictatorship; somewhat, the limiting case would merely be a reproduction of the plain outdated Bitcoin blockchain. Nonetheless, P2Pool has an issue: it requires miners to be absolutely validating nodes. As described above, given the potential of mining with out being a totally validating node that is unacceptable.

One resolution to this downside, and the answer that Ethereum is taking, is to have a mining algorithm that forces nodes to retailer all the blockchain domestically. A easy algorithm for this in Bitcoin’s case is:

def mine(block_header, N, nonce):

o = []

for i in vary(20):

o.append(sha256(block_header + nonce + i))

n = []

for i in vary(20):

B = (o[i] / 2**128) % N

n.append(tx(B, o[i]))

return sha256(block_header + str(n))

The place tx(B, okay) is a perform that returns the kth transaction in block B, wrapping round modulo the variety of transactions in that block if vital, and N is the present block quantity. Notice that it is a easy algorithm and is extremely suboptimal; some apparent optimizations embrace making it serial (ie. o[i+1] depends upon n[i]), constructing a Merkle tree out of the o[i] values to permit them to be individually verified, and, because the Ethereum protocol already does, sustaining a separate state tree and transaction listing so the algorithm solely wants to question the present block. The one minor roadblock to profitable implementation in Ethereum is just that the present trie implementation has no idea of the “kth node” of a tree; the closest analog would most likely should be “first node with a key lexicographically after okay, with wraparound”, one thing for which it’s potential to provide a compact Patricia tree proof.

This truly solves two issues on the identical time. First, it removes the motivation to make use of a centralized pool as a substitute of P2Pool. Second, there may be an ongoing disaster in Bitcoin about how there are too few full nodes; the rationale why that is the case is that sustaining a full node with its 20GB blockchain is pricey, and nobody desires to do it. With this scheme, each single mining ASIC can be compelled to retailer all the blockchain, a state from which performing all the features of a full node turns into trivial.

A second technique is one other cryptographic trick: make mining non-outsourceable. Specificically, the thought is to create a mining algorithm such that, when a miner creates a legitimate block, they all the time essentially have another method of publishing the block that secures the mining reward for themselves. The technique is to make use of a cryptographic building known as a zero-knowledge proof, cryptographically proving that they created a legitimate block however holding the block knowledge secret, after which concurrently create a block with out proof of labor that sends the reward to the miner. This is able to make it trivial to defraud a mining pool, making mining swimming pools non-viable.

Such a setup would require a considerable change to Bitcoin’s mining algorithm, and makes use of cryptographic primitives much more superior than these in the remainder of Bitcoin; arguably, complexity is in itself a severe drawback, and one that’s maybe price it to resolve severe issues like scalability however to not implement a intelligent trick to discourage mining swimming pools. Moreover, making mining swimming pools unimaginable will arguably make the issue worse, not higher. The rationale why mining swimming pools exist is to take care of the issue of variance; miners will not be keen to buy an funding which has solely a 15% likelihood of incomes any return. If the potential of pooling is unimaginable, the mining financial system will merely centralize right into a smaller set of bigger gamers – a setup which, in contrast to now, particular person members can not merely change away from. The earlier scheme, then again, nonetheless permits pooling so long as the native node has the complete blockchain, and thereby encourages a type of pooling (particularly, p2pool) that isn’t systemically dangerous.

One other strategy is much less radical: do not change the mining algorithm in any respect, however change the pooling algorithms. Proper now, most mining swimming pools use a payout scheme known as “pay-per-last-N-shares” (PPLNS) – pay miners per share an quantity primarily based on the income obtained from the previous couple of thousand shares. This algorithm basically splits the pool’s personal variance amongst its customers, leading to no threat for the pool and a small quantity of variance for the customers (eg. utilizing a pool with 1% hashpower, the anticipated normal deviation of month-to-month returns is ~15%, much better than the solo mining lottery however nonetheless non-negligible). Bigger swimming pools have much less variance, as a result of they mine extra blocks (by fundamental statistics, a pool with 4x extra mining energy has a 2x smaller normal deviation as a share). There’s one other scheme, known as PPS (pay-per-share), the place a mining pool merely pays a static quantity per share to miners; this scheme removes all variance from miners, however at the price of introducing threat to the pool; that’s the reason no mining pool does it.

Meni Rosenfeld’s Multi-PPS makes an attempt to offer an answer. As an alternative of mining into one pool, miners can try to provide blocks which pay to many swimming pools concurrently (eg. 5 BTC to at least one pool, 7 BTC to a different, 11.5 BTC to a 3rd and 1.5 BTC to a fourth), and the swimming pools pays the miner for shares proportionately (eg. as a substitute of 1 pool paying 0.024 BTC per share, the primary pool pays 0.0048, the second 0.00672, the third 0.01104 and the fourth 0.00144). This enables very small swimming pools to solely settle for miners giving them very small rewards, permitting them to tackle a stage of threat proportionate to their financial capabilities. For instance, if pool A is 10x greater than pool B, then pool A may settle for blocks with outputs to them as much as 10 BTC, and pool B may solely settle for 1 BTC. If one does the calculations, one can see that the anticipated return for pool B is precisely ten occasions what pool A will get in each circumstance, so pool B has no particular superlinear benefit. In a single-PPS state of affairs, then again, the smaller B would face 3.16x increased threat in comparison with its wealth.

The issue is, to what extent is the issue actually due to variance, and to what extent is it one thing else, like comfort? Positive, a 1% mining pool will see a 15% month-to-month normal deviation in its returns. Nonetheless, all mining swimming pools see one thing like a 40% month-to-month normal deviation of their returns merely due to the unstable BTC value. The distinction between 15% normal deviation and a pair of% normal deviation appears giant and a compelling cause to make use of the biggest pool; the distinction between 42% and 55% not a lot. So what different components may affect mining pool centralization? One other issue is the truth that swimming pools essentially “hear” about their very own blocks immediately and everybody else’s blocks after some community delay, so bigger swimming pools will likely be mining on outdated blocks much less usually; this downside is vital for blockchains with a time of ten seconds, however in Bitcoin the impact is lower than 1% and thus insignificant. A 3rd issue is comfort; this may finest be solved by funding an easy-to-use open-source make-your-own mining pool resolution, in an analogous spirit to the software program utilized by many small VPS suppliers; if deemed essential, we could find yourself partially funding a network-agnostic model of such an effort. The final issue that also stays, nonetheless, is that GHash has no payment; somewhat, the pool sustains itself via its connection to the ASIC cloud-mining firm CEX.io, which controls 25% of its hashpower. Thus, if we wish to actually get all the way down to the underside of the centralization downside, we may have to take a look at ASICs themselves.

ASICs

Initially, Bitcoin mining was meant to be a really egalitarian pursuit. Tens of millions of customers around the globe would all mine Bitcoin on their desktops, and the end result can be concurrently a distribution mannequin that’s extremely egalitarian and broadly spreads out the preliminary BTC provide and a consensus mannequin that features hundreds of stakeholders, nearly precluding any risk of collusion. Initially, the scheme labored, guaranteeing that the primary few million bitcoins bought broadly unfold amongst many hundreds of customers, together with even the usually cash-poor highschool college students. In 2010, nonetheless, got here the arrival of mining software program for the GPU (“graphics processing unit”), making the most of the GPU’s huge parallelization to attain 10-100x speedups and rendering CPU mining utterly unprofitable inside months. In 2013, specialization took an extra flip with the arrival of ASICs. ASICs, or application-specific built-in circuits, are specialised mining chips produced with a single goal: to crank out as many SHA256 computations as potential so as to mine Bitcoin blocks. Because of this specialization, ASICs get an extra 10-100x speedup over GPUs, rendering GPU mining unprofitable as effectively. Now, the one strategy to mine is to both begin an ASIC firm or buy an ASIC from an present one.

The way in which the ASIC firms work is easy. First, the corporate begins up, does some minimal quantity of setup work and figures out its plan, and begins taking preorders. These preorders are then used to fund the event of the ASIC, and as soon as the ASICs are prepared the units are shipped to customers, and the corporate begins manufacturing and promoting extra at an everyday tempo. ASIC manufacturing is completed in a pipeline; there may be one kind of manufacturing unit which produces the chips for ASICs, after which one other, much less subtle, operation, the place the chips, along with normal elements like circuit boards and followers, are put collectively into full containers to be shipped to purchasers.

So the place does this depart us? It is apparent that ASIC manufacturing is pretty centralized; there are one thing like 10-30 firms manufacturing these units, and every of them have a big stage of hashpower. Nonetheless, I didn’t understand simply how centralized ASIC manufacturing is till I visited this unassuming little constructing in Shenzhen, China:

On the third flooring of the manufacturing unit, we see:

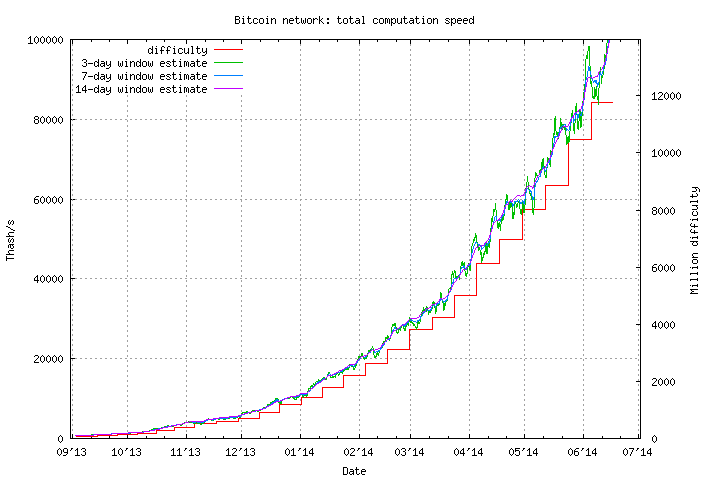

What we now have within the first image are about 150 miners of 780 GH/s every, making up a complete 120 TH/s of miners – greater than 0.1% of complete community hashpower – multi function place. The second image exhibits containers containing one other 150 TH/s. Altogether, the manufacturing unit produces barely greater than the sum of those two quantities – about 300 TH/s – each single day. Now, have a look at this chart:

In complete, the Bitcoin community positive factors about 800 TH/s daily. Thus, even including some security components and assuming the manufacturing unit shuts down some days per week, what we now have is one single manufacturing unit producing over 1 / 4 of all new hashpower being added to the Bitcoin community. Now, the constructing is a bit giant, so guess what’s on the primary flooring? That is proper, a fabrication facility producing Scrypt ASICs equal to 1 / 4 of all new hashpower added to the Litecoin community. This tasks a picture of a daunting endgame for Bitcoin: the Bitcoin community spending hundreds of thousands of {dollars} of electrical energy yearly solely to switch the US greenback’s mining algorithm of “8 white guys” with just a few dozen guys in Shenzhen.

Nonetheless, earlier than we get too alarmist about the way forward for mining, it is very important dig down and perceive (1) what’s fallacious with ASICs, (2) what’s okay with CPUs, and (3) what the way forward for ASIC mining goes to seem like. The query is a extra advanced one than it appears. To start with, one may ask, why is it dangerous that ASICs are solely produced by just a few firms and 1 / 4 of them move via one manufacturing unit? CPUs are additionally extremely centralized; built-in circuits are being produced by solely a small variety of firms, and practically all computer systems that we use have a minimum of some elements from AMD or Intel. The reply is, though AMD and Intel produce the CPUs, they don’t management what’s run on them. They’re general-purpose units, and there’s no method for the producers to translate their management over the manufacturing course of into any type of management over its use. DRM-laden “trusted computing modules” do exist, however it is extremely tough to think about such a factor getting used to power a pc to take part in a double-spend assault.

With ASIC miners, proper now issues are nonetheless not too dangerous. Though ASICs are produced in solely a small variety of factories, they’re nonetheless managed by hundreds of individuals worldwide in disparate knowledge facilities and houses, and particular person miners every normally with lower than just a few terahashes have the power to direct their hashpower wherever they want. Quickly, nonetheless, which will change. In a month’s time, what if the producers understand that it doesn’t make financial sense for them to promote their ASICs once they can as a substitute merely hold all of their units in a central warehouse and earn the complete income? Delivery prices would drop to near-zero, transport delays would go down (one week transport delay corresponds to ~5.6% income loss at present hashpower development charges) and there can be no want to provide steady or fairly casings. In that state of affairs, it will not simply be 25% of all ASICs which are produced by one manufacturing unit in Shenzhen; it will be 25% of all hashpower run out of one manufacturing unit in Shenzhen.

When visiting the headquarters of an organization in Hangzhou that’s concerned, amongst different issues, in Litecoin mining, I requested the founders the identical query: why do not you simply hold miners in-house? They supplied three solutions. First, they care about decentralization. That is easy to know, and may be very lucky that so many miners really feel this fashion in the interim, however finally mining will likely be carried out by corporations that care just a little extra about financial revenue and fewer about ideology. Second, they want pre-orders to fund the corporate. Affordable, however solvable by issuing “mining contracts” (basically, crypto-assets which pay out dividends equal to a selected variety of GH/s of mining energy). Third, there’s not sufficient electrical energy and house within the warehouses. The final argument, as specious because it appears, would be the just one to carry water in the long run; it’s also the said cause why ASICminer stopped mining purely in-house and began promoting USB miners to customers, suggesting that maybe there’s a sturdy and common rationale behind such a choice.

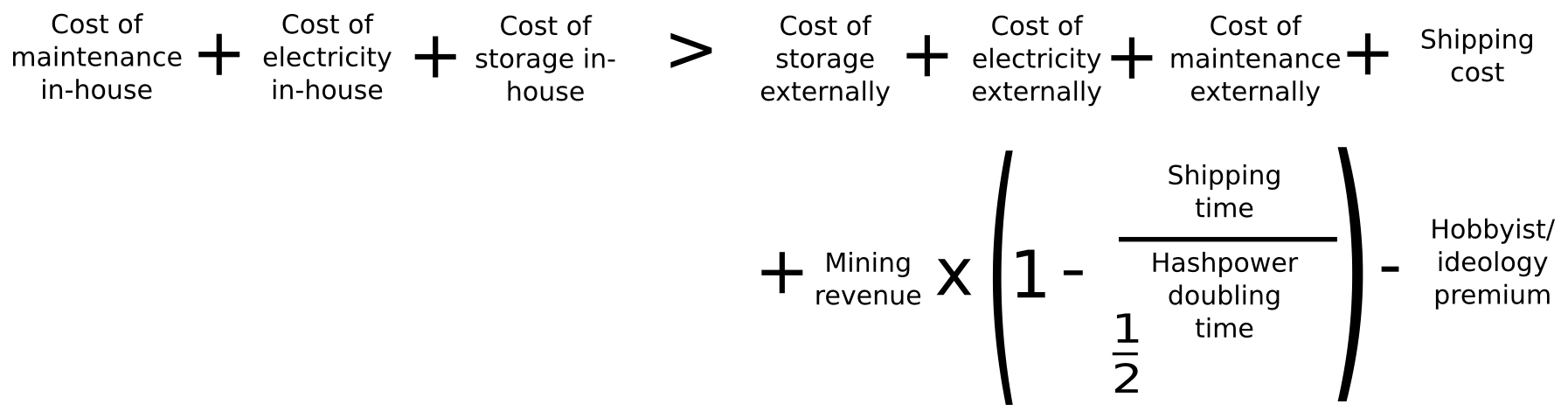

Assuming that the funding methods of promoting pre-orders and promoting mining contracts are economically equal (which they’re), the equation for figuring out whether or not in-house mining or promoting makes extra sense is as follows:

On the left facet, we now have the prices of in-house mining: electrical energy, storage and upkeep. On the fitting facet, we now have the price of electrical energy, storage and upkeep externally (ie. in consumers’ arms), transport and the penalty from having to begin operating the ASIC later, in addition to a detrimental issue to account for the truth that some folks mine a minimum of partially for enjoyable and out of an ideological need to help the community. Let’s analyze these figures proper now. We’ll use the Butterfly Labs Monarch as our instance, and hold every ASIC operating for one yr for simplicity.

- Inner electrical energy, storage, upkeep – in accordance with BFL’s checkout web page, inside electrical energy, storage and maintennance price $1512 per yr, which we’ll mark all the way down to $1000 assuming BFL takes some revenue

- Exterior electrical energy – in Ontario, costs are about $0.1 per KwH. A Butterfly Labs Monarch will run 600 GH/s at 350 W; normalizing this to per-TH, this implies an electrical energy price of $1.40 per day or $511 for all the yr

- Exterior storage – at dwelling, one can contemplate storage free, or one can add a comfort payment of $1 per day; therefore, we’ll say someplace from $0 to $365

- Exterior upkeep – laborious to quantify this worth; for technically expert invididuals who benefit from the problem it is zero, and for others it may be laborious; therefore, we are able to say $0 to $730

- Delivery price – in accordance with BFL, $38.

- Income – presently, 1 TH/s offers you 0.036 BTC or $21.6 per day. Since in our evaluation hashpower doubles each 90 days, so the effectiveness of the ASIC halves each 90 days, we get 122 days of life or $2562 income

- Delivery time – in accordance with my Chinese language sources, one week

- Hashpower doubling time – three months. Therefore, all the expression for the transport delay penalty is 2562 * (1 – 0.5 ^ 0.0769) = 133.02

- Hobbyist/ideology premium – presently, a big portion of Bitcoin miners are doing it out of ideological issues, so we are able to say wherever from $0 to $1000

Thus, including all of it up, on the left we now have $1000, and on the fitting we now have $511 + $38 + $133 = $682, as much as plus $1095 and minus as much as $1000. Thus, it is totally ambiguous which one is best; errors in my evaluation and the nebulous variables of how a lot folks worth their time and aesthetics appear to far outweigh any particular conclusions. However what’s going to occur sooner or later? Basically, one can anticipate that electrical energy, storage and upkeep can be less expensive centrally than with every shopper merely attributable to economies of scale and positive factors from specialization; moreover most individuals within the “actual world” will not be altruists, hobbyists or admirers of lovely ASIC coverings. Delivery price are above zero, and the transport delay penalty is above zero. So thus plainly the economics roundly favor centralized mining…

… aside from one potential issue: warmth. Proper now, ASICs are nonetheless in a speedy growth part, so the overwhelming majority of the fee is {hardware}; the BFL miner used within the above instance prices 511. Sooner or later, nonetheless, growth will likely be a lot slower; finally we are able to anticipate a convergence to Moore’s legislation, with hashpower doubling each two years, and even Moore’s legislation itself appears to be slowing. In such a world, electrical energy prices could come again as the first choke level. However how a lot does electrical energy price? In a centralized warehouse, quite a bit, and the square-cube legislation ensures that in a centralized atmosphere much more vitality than at dwelling would should be spent on cooling as a result of all the miners are in a single place and most of them are too deep contained in the manufacturing unit to have publicity to chill contemporary air. In a house, nonetheless, if the skin temperature is lower than about 20’C, the price of electrical energy is zero; all electrical energy spent by the miner essentially ultimately turns into “waste” warmth, which then heats the house and substitutes for electrical energy that may be spent by a central heater. That is the one argument for why ASIC decentralization may match: somewhat than decentralization occurring as a result of everybody has a sure amount of unused, and thereby free, models of computational time on their laptop computer, decentralization occurs as a result of many individuals have a sure amount of demand for heating of their houses.

Will this occur? Many Bitcoin proponents appear satisfied that the reply is sure. Nonetheless, I’m not certain; it’s a wholly empirical query whether or not or not electrical energy price is lower than upkeep plus storage plus transport plus transport delay penalty, and in ten years’ time the equation could effectively fall on one facet or the opposite. I personally am not keen to easily sit again and hope for one of the best. That is why I personally discover it disappointing that so lots of the core Bitcoin builders (although thankfully not practically all) are content material to think about the proof of labor downside “solved” or argue that trying to resolve mining specialization is an act of “useless re-engineering”. It might show to be, or it could not, however the truth that we’re having this dialogue within the first place strongly means that Bitcoin’s present strategy may be very removed from good.

ASIC Resistance

The answer to the ASIC downside that’s most frequently touted is the event of ASIC-resistant mining algorithms. To date, there have been two traces of thought in creating such algorithms. The primary is memory-hardness – decreasing the facility of ASICs to attain huge positive factors via parallelization through the use of a perform which takes a really great amount of reminiscence. The group’s first try was Scrypt, which proved to be not resistant sufficient; in January, I tried to enhance Scrypt’s memory-hardness with Dagger, an algorithm which is memory-hard to compute (to the extent of 128 MB) however simple to confirm; nonetheless, this algorithm is susceptible to shared-memory assaults the place a variety of parallel processes can entry the identical 128 MB of reminiscence. The present state-of-the-art in memory-hard PoW is Cuckoo, an algorithm which appears for length-42 cycles in graphs. It takes a considerable amount of reminiscence to effectively discover such cycles, however a cycle may be very fast to confirm, requiring 42 hashes and fewer than 70 bytes of reminiscence.

The second strategy is considerably totally different: create a mechanism for producing new hash features, and make the house of features that it generates so giant that the type of pc finest suited to processing them is by definition utterly generalized, ie. a CPU. This strategy will get near being “provably ASIC resistant” and thus extra future-proof, somewhat than specializing in particular elements like reminiscence, but it surely too is imperfect; there’ll all the time be a minimum of some elements of a CPU that can show to be extraneous in such an algorithm and could be eliminated for effectivity. Nonetheless, the search is just not for good ASIC resistance; somewhat, the problem is to attain what we are able to name “financial ASIC resistance” – constructing an ASIC shouldn’t be price it.

That is truly surprisingly more likely to be achievable. To see why, word that mining output per greenback spent is, for most individuals, sublinear. The primary N models of mining energy are very low-cost to provide, since customers can merely use the prevailing unused computational time on their desktops and solely pay for electrical energy (E). Going past N models, nonetheless, one must pay for each {hardware} and electrical energy (H + E). If ASICs are possible, so long as their speedup over commodity {hardware} is lower than (H + E) / E, then even in an ASIC-containing ecosystem will probably be worthwhile for folks to spend their electrical energy mining on their desktops. That is the objective that we want to attempt for; whether or not we are able to attain it or not is totally unknown, however since cryptocurrency as a complete is a large experiment in any case it doesn’t harm to attempt.

from Ethereum – My Blog https://ift.tt/I0x7wH5

via IFTTT